$HAYPP Watch: August 2025

Signal over noise; slight August pullback; baseline strength persists

Welcome to my second monthly Haypp recap. Same goal as before; give you a full picture between quarters so you do not have to wait for earnings.

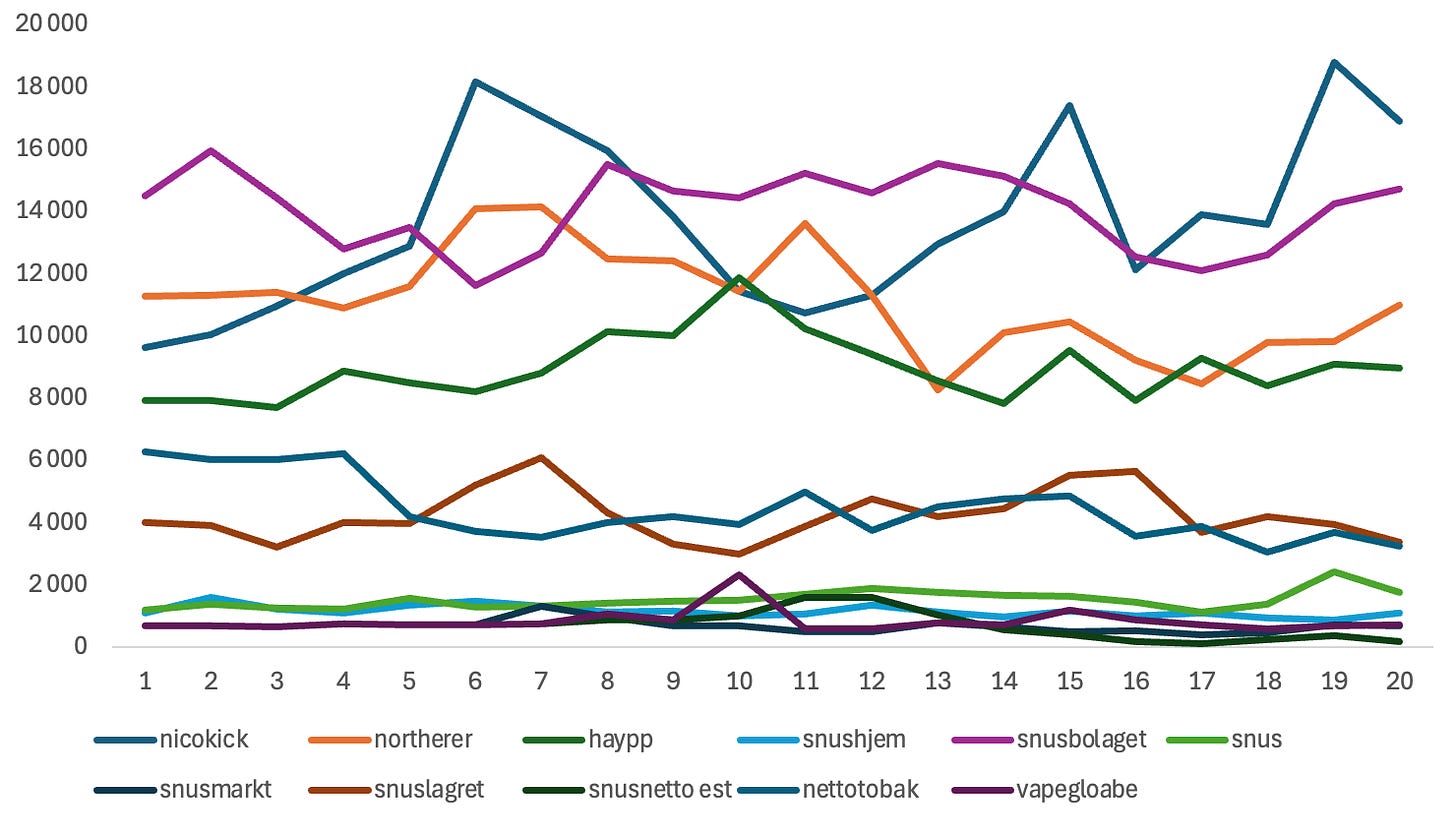

I remain constructive on Q3; July’s web traffic across Haypp Group sites rose 17% vs the Q2 average and pushed toward all-time highs. Historically that has signalled revenue momentum.

August update: traffic slipped 3,2% month over month; we are still roughly 14% above the Q2 baseline. Assuming linearity, that maps to revenues around 1 050 MSEK; it is still early and the estimate will tighten as more data settles.

What the August Traffic Tells Us

August saw a small month-over-month decline after July’s 17% surge; the dip was mainly a slight pullback at Nicokick. Even so, overall traffic remains at very high levels compared to last quarter; we are still roughly 14% above the Q2 baseline. The clearest shift in the mix was Snusbolaget’s strong performance. Not all web traffic is equal; basket sizes differ between markets. In practice, increases in Swedish traffic tend to correlate more with sales than similar gains in the U.S., because Swedish baskets are larger; that is my working assumption. Otherwise, August was uneventful from a traffic standpoint. The data continue to point to a strong quarter; I see very good odds of exceeding 1 000 MSEK, and on a simple linear mapping the read-through is around 1 050 MSEK. Next, I will discuss other August events and any changes I see.

Potential for error

Historically my web-traffic–based predictions have landed within roughly ±3 percentage points of reported revenue; in most quarters the absolute miss has been in the low single digits; overall it has been a reliable leading indicator. Recently I have grown more cautious. The concern started when I saw a large divergence between LULU’s web traffic and Google Trends. Google Trends seems less reliable right now; LLM activity can inflate or distort query volumes, weakening the signal. That raised a broader question: could LLMs also affect website metrics in a similar way via automated browsing or scraping that looks like human interest?

I have not fully resolved this; treat the signal with a grain of salt. Traffic can be manipulated or polluted by bots; filters are not perfect. And most recently, in Q2 I missed by quite a bit more; the model could not adjust for the mix change caused by the ZYN shortage and lost sales in San Francisco.

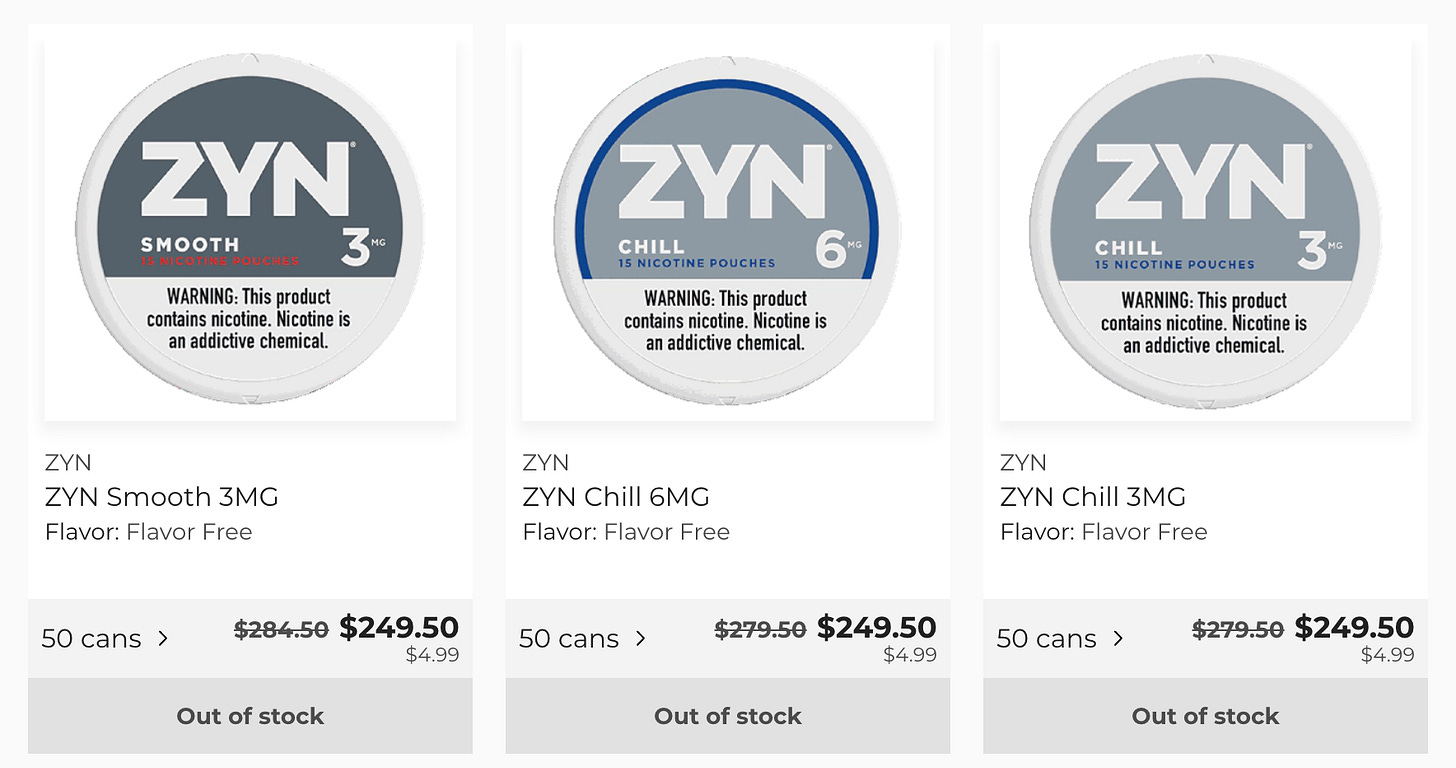

Zyn is back

A few days ago it was announced that ZYN will return to Haypp’s U.S. stores; the agreement is for direct supply from Philip Morris. This is unequivocally positive; the open question is the size and timing of the impact. I wrote a separate piece on this; feel free to check it out for detail. In short: how much will ZYN add and how fast? The market has grown; but customers also need time to switch back. The effect could be large, potentially closer to 200 MSEK per quarter; or it may take time to re-acquire ZYN customers, implying something nearer 50 MSEK. Time will tell. I will be monitoring Nicokick and Northerner web traffic closely as supply returns; that should give us an early read over the coming month.

As of today; Zyn is still out of stock.

France doing luddite stuff

France has now formalized a nationwide ban on oral nicotine products, including pouches; the decree was published on 6 September 2025 and is set to take effect in 2026.

Context: the government’s plan had been flagged earlier this year; EU objections delayed the timeline over the summer, but the European Commission has since cleared France to proceed. With the decree in the Official Journal, enforcement looks likely; litigation or further EU-level pushback could still emerge, yet the policy path is clear.

For Haypp this is close to a non-event in the near term. Haypp does not operate in France; the French market for pouches is nascent; consumer adoption is low compared with Sweden or the U.S. If anything, France risks becoming a cautionary example for harm reduction rather than a headwind to Haypp’s current footprint.

End note

All in all, Haypp looks strong heading into year-end. I think an uplisting is quite likely soon; that would be a major catalyst. The stock has run, but we are still trading only slightly above a P/S of 1. This is a high-growth company with a durable, capital-light model that, in my view, supports a materially higher valuation; if growth continues to pick up this quarter, P/S will likely fall below 1 at today’s price within a year. If you are new to Haypp or want a deeper understanding of the business, read my deep dive and subscribe to my Substack. Please feel free to share my work if you like it.