Haypp Group: Deep Dive

The Best Winner of the Nicotine Pouch Boom $HAYPP (Updated September)

Nicotine pouches are one of the fastest-growing consumer products; they are rapidly taking share from smoking and even vapes. They are way healthier than smoking; discreet; cheaper per use; no smoke or vapor; consistent dosing; easy to carry; better in most practical ways.

If you want to invest in the trend, there are not many pure options; most big tobacco names are diversified; many pouch brands are private. My favorite is Haypp Group $HAYPP; the Swedish nicotine-pouch company profiting directly from the boom through its online platforms. In this deep dive I will cover everything that matters about Haypp; segments; sites; markets; and what drives the next leg of growth.

Haypp first landed on my radar roughly a year and a half ago; I took a small starter position and added on the way up in the 110 SEK range. Then came the hits; a ZYN shortage; a US lawsuit; and a revoked license in Sweden. The stock halved. That is when I leaned in. By then I had enough conviction and understanding to size it as a real position; so I kept buying into the lows.

Fast forward to today and that decision aged well; but I think this is just the beginning. Most people in the world still do not know what nicotine pouches are; many have never tried them. That will likely change. In my view the category can 30x over the next twenty years; and Haypp is positioned to capture a meaningful share of that growth.

If you read the original Haypp deep dive, here’s what has been updated in this version:

ZYN’s return to Nicokick and Northerner in mid-September via a direct PMI agreement

The French ban on nicotine pouches and its implications for expansion markets

Revised valuation range (SEK 193–450) reflecting the scale of US growth potential

Updated catalysts section to account for ZYN’s comeback and Haypp’s recent share price move

Closing section noting ~10% stock gain since the last deep dive, alongside recent headwinds (Gavin’s sales and French headlines)

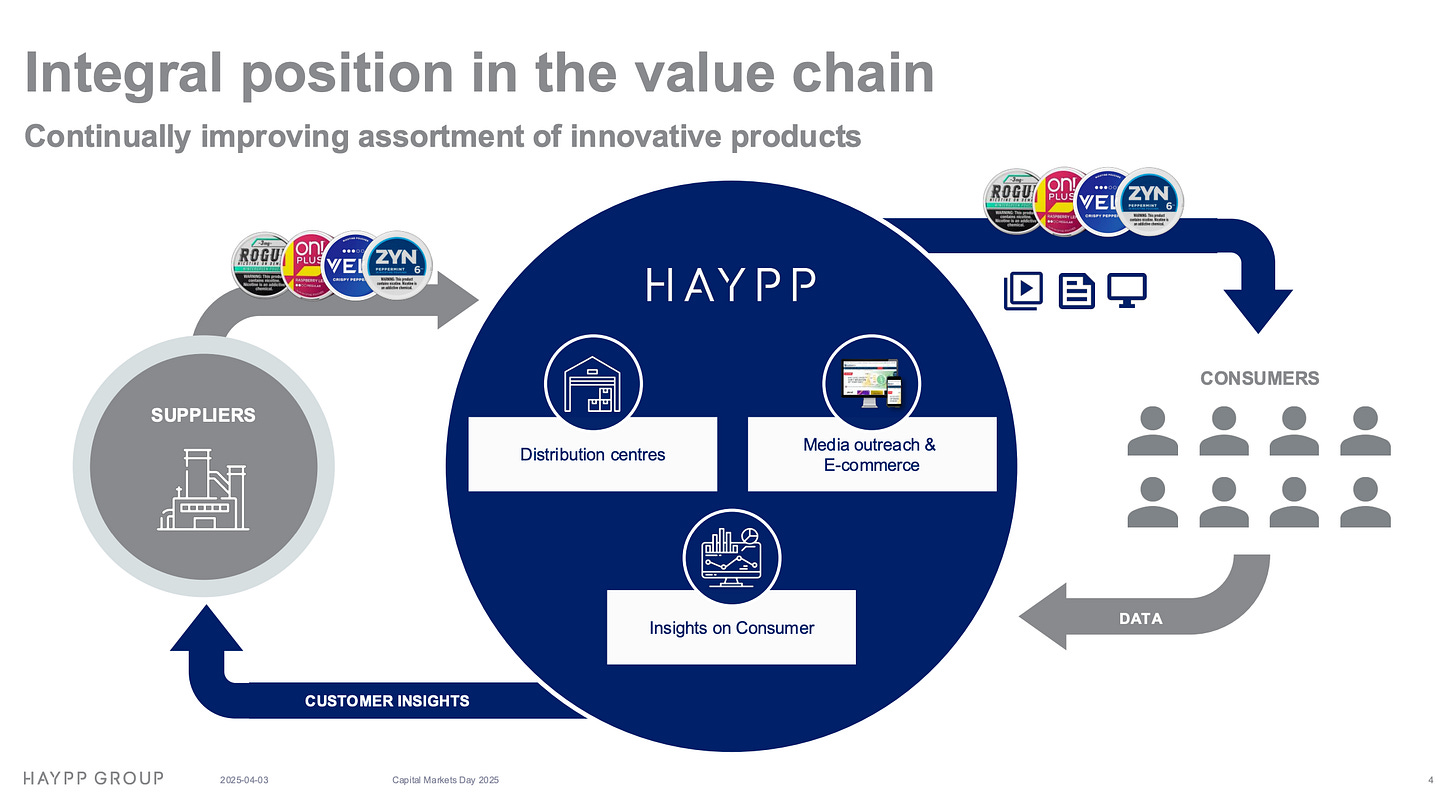

What does Haypp do?

Haypp is an e-commerce business that sells nicotine pouches, snus, and vapes across Sweden; Norway; DACH; the UK; and the US. They buy finished products from suppliers like British American Tobacco’s Velo; then sell directly to consumers through their portfolio of websites.

This is a low-margin retail model; Haypp currently runs at roughly 19 percent gross margin. In practice a customer adds one or more cans to the cart on a site like Snusbolaget or Haypp; pays online; and Haypp earns a few bucks per order. The parcel arrives a few days later; repeat purchases drive the engine.

Do not confuse low margin with low quality; Haypp is far from a boring e-commerce shop with no moat.

Each time Haypp sells a can of nicotine pouches and books a small retail margin, a second asset compounds in the background; data. Every order captures structured signals; brand and SKU; flavor and strength; format and pack size; price paid and discount; device and channel; delivery choice; location; reorder cadence. Over time this builds longitudinal cohorts that show how real customers move from trial to habit; which flavors they switch to; how strength preferences evolve; what promotions change behavior; and when baskets expand.

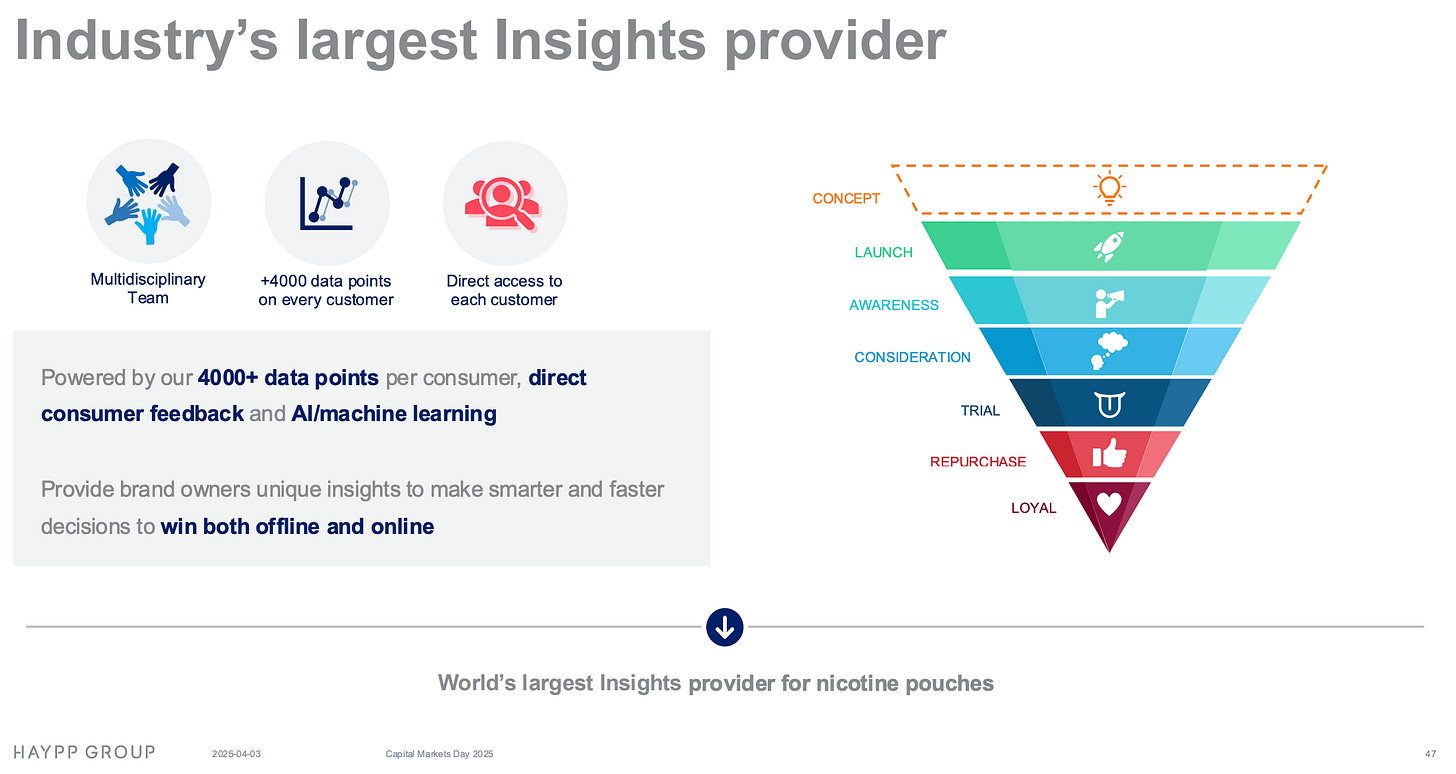

Haypp Media & Insights turns that stream into products; paid reports; custom analyses; and decision support for suppliers and regulators. Typical outputs include new-product screening; flavor and strength optimization; price elasticity curves; subscription propensity; promotion lift; and age-gating friction metrics. For suppliers like Philip Morris and British American Tobacco this is scarce and valuable; most in-store sales flow through intermediaries that do not expose consumer-level behavior. Haypp sees the shopper at the edge; at SKU and click level; across markets; in something close to real time.

This means Haypp, in addition to e-commerce, has a secondary business layered on top that is highly profitable; the result is an e-commerce model with a huge structural data advantage. Haypp is the largest online nicotine-pouch retailer in every market it operates in. Right now the Media & Insights business generates almost 10% of revenue; margins are at least half of that; giving Haypp roughly a 5% cost advantage on selling nicotine pouches purely from data collection.

Why nicotine pouches?

To understand Haypp and why it’s interesting, you have to understand the opportunity in nicotine pouches. Everyone has heard of nicotine; mostly in a negative way; the “addictive ingredient” in tobacco; and yes, it’s been used as a bug killer. Both are true. However, nicotine itself does not seem to be very toxic to humans at typical consumer exposures; it is highly addictive; cheap; and there’s work suggesting improved cognitive capacity for some users; e.g., people with ADHD often report better focus.

In a nutshell, we have a cheap product that is highly addictive and seems to have minimal downside for many users; yes, there are health risks; but they aren’t drastic enough for most consumers to care; after all, every piece of candy you eat “kills” you in the long run.

What we have here is a product that is superior in almost every way. Consumers prefer it; regulators prefer it; companies prefer it. For users it’s cleaner; discreet; cheaper; easier to live with. For companies it carries better unit economics; longer cash-flow runways; and supports higher valuations. For regulators it’s a practical harm-reduction path that moves smokers into nicotine pouches.

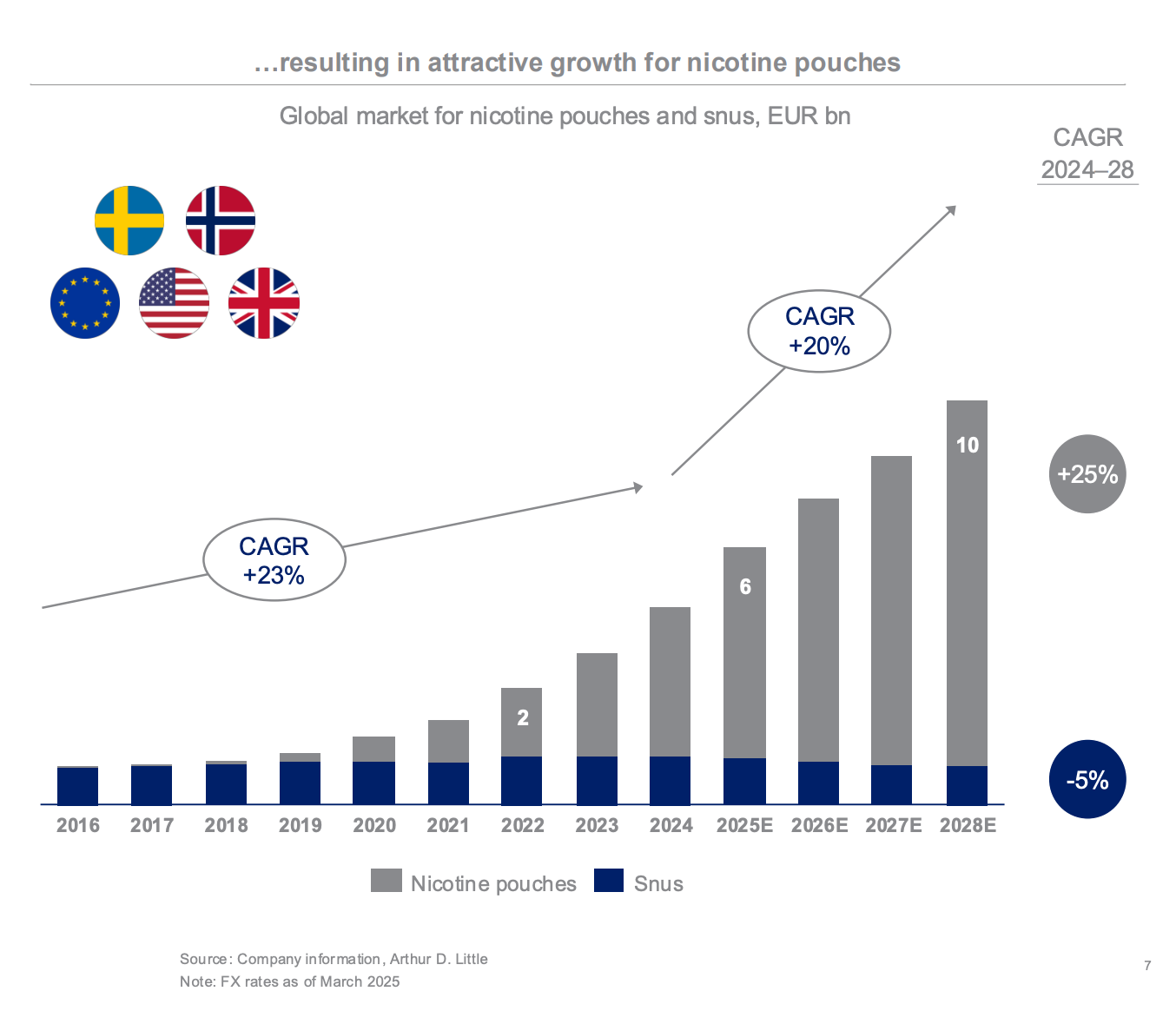

But the market is still early. Tobacco still dominates; globally there are far more smokers than pouch users. That is about to change. Look at Sweden and Norway; you see mass switching. Smoking is too harmful and no longer socially accepted. My view: the nicotine-pouch market is set to grow at an incredible pace until smokers are essentially gone. For investors that implies around 20% CAGR over the next decade; with some markets growing far faster right now.

.

Websites and Markets; Brand-by-Brand

Haypp Group consists of 11 websites that sell snus, nicotine pouches, and vapes. Their operations are split into three segments. The Core segment includes Sweden and Norway, where snus and nicotine pouches are well established and form the backbone of Haypp’s profitability. The Growth segment covers Germany, Austria, Switzerland, the United Kingdom, and the United States, where nicotine pouches are growing rapidly but are still in an earlier stage of adoption. The Emerging segment focuses on vapes and heated tobacco, mainly through dedicated vape stores in the UK and Germany.

The difference between Growth and Core is surprisingly large; it is a central part of the Haypp thesis. In Core markets like Sweden and Norway, usage is mature; repeat rates are high; order patterns are predictable. Growth markets look very different. New pouch users often start light; roughly one can per week. After a couple of years many settle into a daily habit; that shift alone turns a customer into a 7x heavier consumer without Haypp adding a single new user.

This cohort maturation drives powerful compounding. As light users age into heavy users, baskets get bigger; reorder frequency rises; subscription uptake improves; fulfillment routes densify; CAC payback shortens. The same customer base can deliver step-function growth in volumes and gross profit as behavior shifts from trial to routine. That is why the US and UK matter so much; they are still converting early cohorts, while Core already sits near steady state.

This structure allows Haypp to balance stable cash flow from mature markets with expansion into new, high-growth geographies and categories. Core secures the base, Growth drives the long-term opportunity, and Emerging positions the group in evolving nicotine alternatives.

Next, I will quickly go over each site.

Haypp is the group’s flagship in Europe; one brand running localized sites for the UK, Germany, Austria, and Sweden. In segment terms it straddles Core and Growth; Sweden belongs to Core; the UK, Germany, and Austria belong to Growth. Over the last year Haypp has been among the fastest growers in the portfolio.

By focus, Haypp is primarily a nicotine-pouch banner. Germany and Austria are pouch-first markets. The UK is also pouch-led even though the catalog is broad; pouches anchor the proposition.

Snusbolaget is Haypp Group’s Swedish flagship in the Core segment; it sells traditional snus and also offers nicotine pouches. It is currently the largest site by sales; but its share has been shrinking as nicotine pouches take market share across the portfolio; it likely will not remain the largest over time.

Snusnetto and Nettotobak sit in Sweden within the Core segment; both are snus-led with some DIY supplies and nicotine pouches. Snusnetto is very small; traffic has plummeted over the last year; it almost looks like Haypp is phasing the site out.

Nettotobak is mid sized; but web traffic has dropped sharply; suggesting sales are close to half of what they were two years ago. Net read: these two look like legacy coverage for niche customers rather than growth engines.

Segment: Core; Location: Norway.

These three are Norway-focused; snus first with nicotine pouches alongside. The market is mature; reorder driven; no explosive growth. You cannot show products the way you can elsewhere; strict presentation and marketing rules shape how these sites operate and grow. That makes the Norway cluster more interesting for regulatory watching than for near-term volume upside; any future rule changes could materially shift visibility; conversion; and growth. For now they function as steady platforms serving loyal users rather than portfolio growth engines.

Segment: Growth; Location: Switzerland.

It is one of the smaller sites; among the weaker performers by traffic and sales. That makes it interesting strategically; it shows how Haypp fares when entering a market later; with more competition; and tighter rules. The offer is snus led with nicotine pouches available; repeat purchase driven; more signal than scale for the group.

Northerner serves the United States; the United Kingdom; Germany; and Austria; with the US as the clear anchor. The focus is nicotine pouches; snus is offered where allowed. By web traffic it is currently the third-largest site in the group; just ahead of Haypp. With the US nicotine-pouch boom accelerating and Haypp’s US operations scaling, Northerner has substantial upside from here.

Nicokick serves the United States; segment is Growth; focus is nicotine pouches. It is currently the number one site by web traffic in the group; and is likely to become number one by sales as US adoption continues to accelerate. The brand faced a temporary setback from ZYN supply constraints; but availability is normalizing and performance should rebound in Q3. Net read; Nicokick is the clearest near-term upside lever in the portfolio.

VapeGlobe sits in the Emerging segment; markets are the UK and Germany. Sales are still minimal; losses are large; but growth is rapid. Most people ignore this part of the business; yet it could become a meaningful segment in the not-so-distant future. Strategically it lets Haypp test its playbook in a different category; generating valuable learnings on CAC, merchandising, and age-gating that can feed back into the core. Keep an eye on it.

Market outlook and where Haypp goes next

Haypp already spans a wide range of countries and segments; the runway is still long. The clearest near-term growth sits in the US and the UK; nicotine-pouch adoption is compounding and the e-commerce playbook scales well. Sweden and Norway are steady profit engines; culturally entrenched oral nicotine; predictable reorders; disciplined operations.

DACH shows momentum but not dominance. Germany is the hinge; winning it will take sustained commitment on content, logistics, and local execution. The hesitation is regulatory; with rules in flux, Haypp has been reluctant to fully commit the resources needed to break through. Once EU clarity improves; expect a firmer push.

Central and Southern Europe remain uncertain; policy is the bottleneck. Without clearer EU and national frameworks, the risk-adjusted return on new launches is lower than doubling down where demand and rules are already workable.

Asia is the strategic swing. Gavin (CEO) answered my question about Asia like this: “Asia is ready but Haypp isn’t.” Translation; the opportunity is real, but spreading the organization too thin would dilute execution in the US and Europe. The likely path is sequence, not sprawl; establish unambiguous US leadership first, then make targeted entries or acquisitions in select Asian markets once the operating model can support it.

Strategy

The flywheel; how Haypp compounds

Think of Haypp as two businesses working together; a retailer that ships cans and a data company that learns from every order. When a new customer lands on a site and buys a trial mix, Haypp captures clean, structured signals; brand; flavor; strength; can size; price paid; delivery choice; reorder timing. That dataset grows with each purchase; across countries; across months; across thousands of cohorts.

Data turns into targeting. The sites learn which SKUs convert first-time buyers; which flavors people switch to on order three; when a user is most likely to accept a subscription; which delivery options reduce failed handoffs. Search results and recommendations improve; promotions are timed to actual reorder windows; landing pages reflect what works in that country. Conversion rises; churn falls; fewer clicks are wasted.

Targeting lifts value per customer. Baskets get a bit larger; reorder frequency ticks up; subscriptions smooth demand; returns drop. Lifetime value rises; payback periods shorten; paid channels can be pushed harder without destroying contribution. The same traffic produces more gross profit.

Higher customer value creates supplier leverage. With predictable volumes and precise demand signals, Haypp negotiates better terms; earlier allocations; co-op budgets for launches; exclusives in some cases. Media & Insights adds another lever; suppliers pay for reports that help them tune flavors and strengths; regulators buy category overviews; this offsets retail costs.

Leverage funds price and speed. Buying terms improve; pick paths get denser; last-mile rates step down; working capital turns faster. Haypp can offer sharper prices; free shipping thresholds; quicker delivery windows; and it can do this sustainably because unit costs are falling as scale rises.

Price and speed bring more customers. Better value wins trials; reliability builds habit; authority in search compounds; direct traffic climbs; CAC mixes down as organic grows. The brand becomes a default choice for the category in each market it serves.

Regulation and trust lock the gains. Age checks; KYC; product presentation limits; and local tax rules are handled cleanly; errors and failed deliveries drop; approval rates improve. That competence is hard to copy at scale; it lowers friction for users and for suppliers that want a compliant online channel.

More customers feed more data; targeting improves again; supplier terms tighten again; operations get denser again. The loop repeats. Over time the gap between Haypp and followers widens; not because the storefront looks different, but because the engine behind it keeps getting smarter; cheaper; and faster with every can sold.

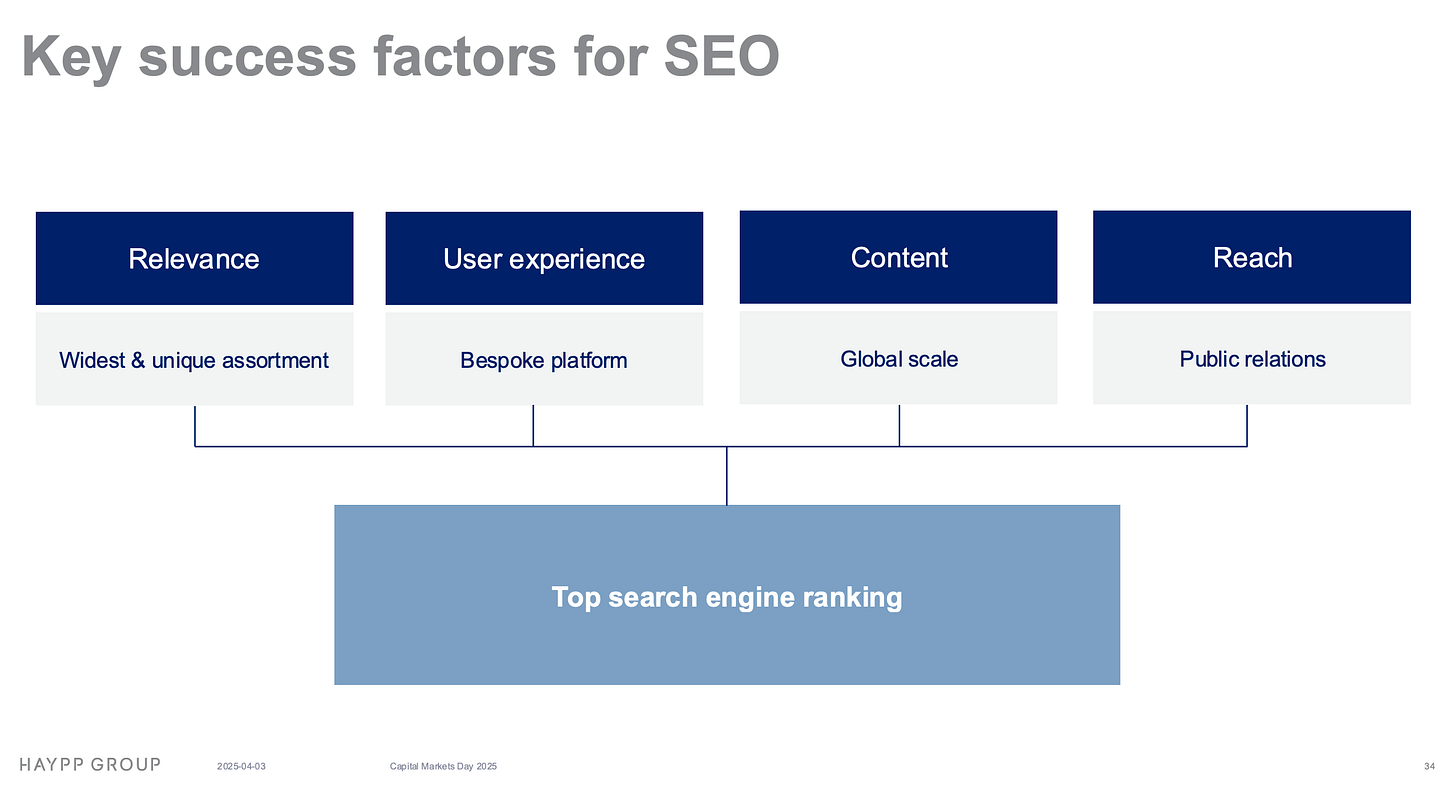

First-mover advantage and SEO strategy

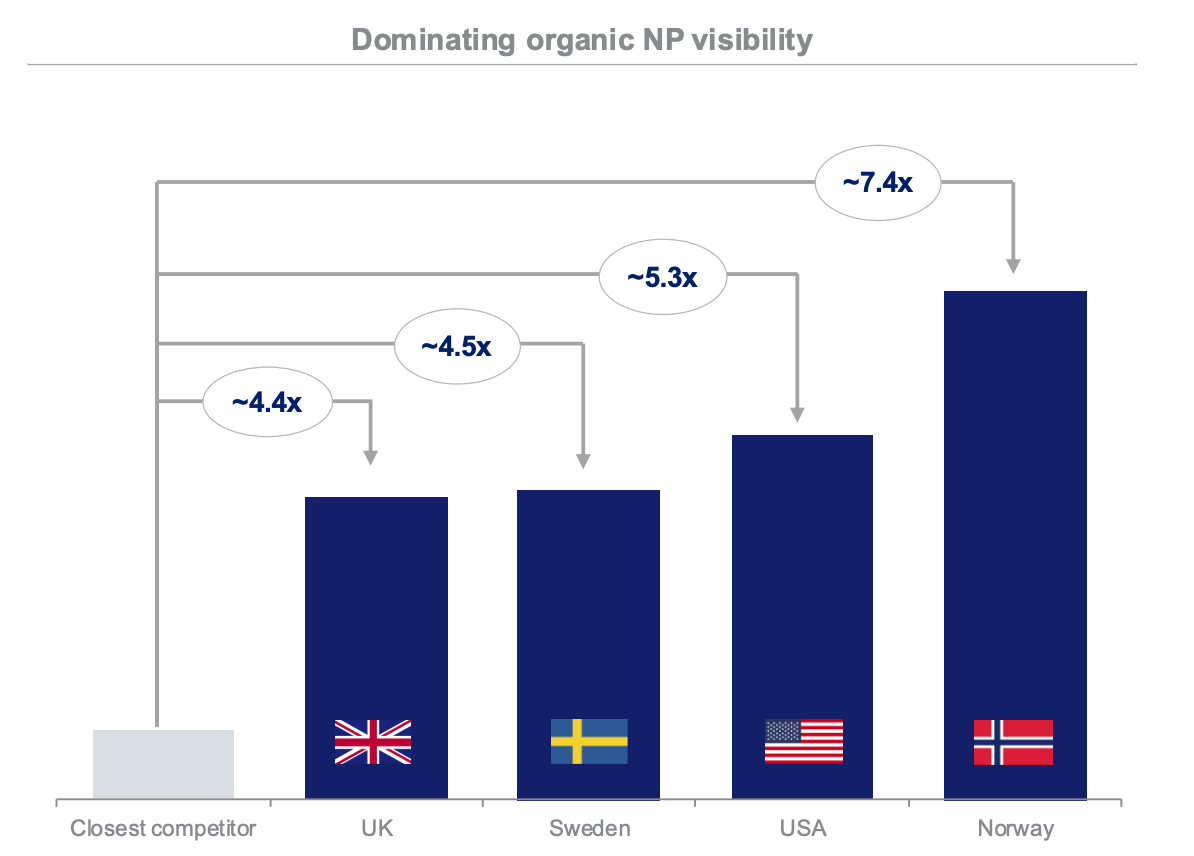

Haypp is far larger than the next online competitor in every market it serves; typically by more than five times. Being first created default destinations for pouches and snus; people recognize the site names; trust them; return; and recommend them to friends. That familiarity compounds into brand searches and direct traffic that competitors cannot easily replicate.

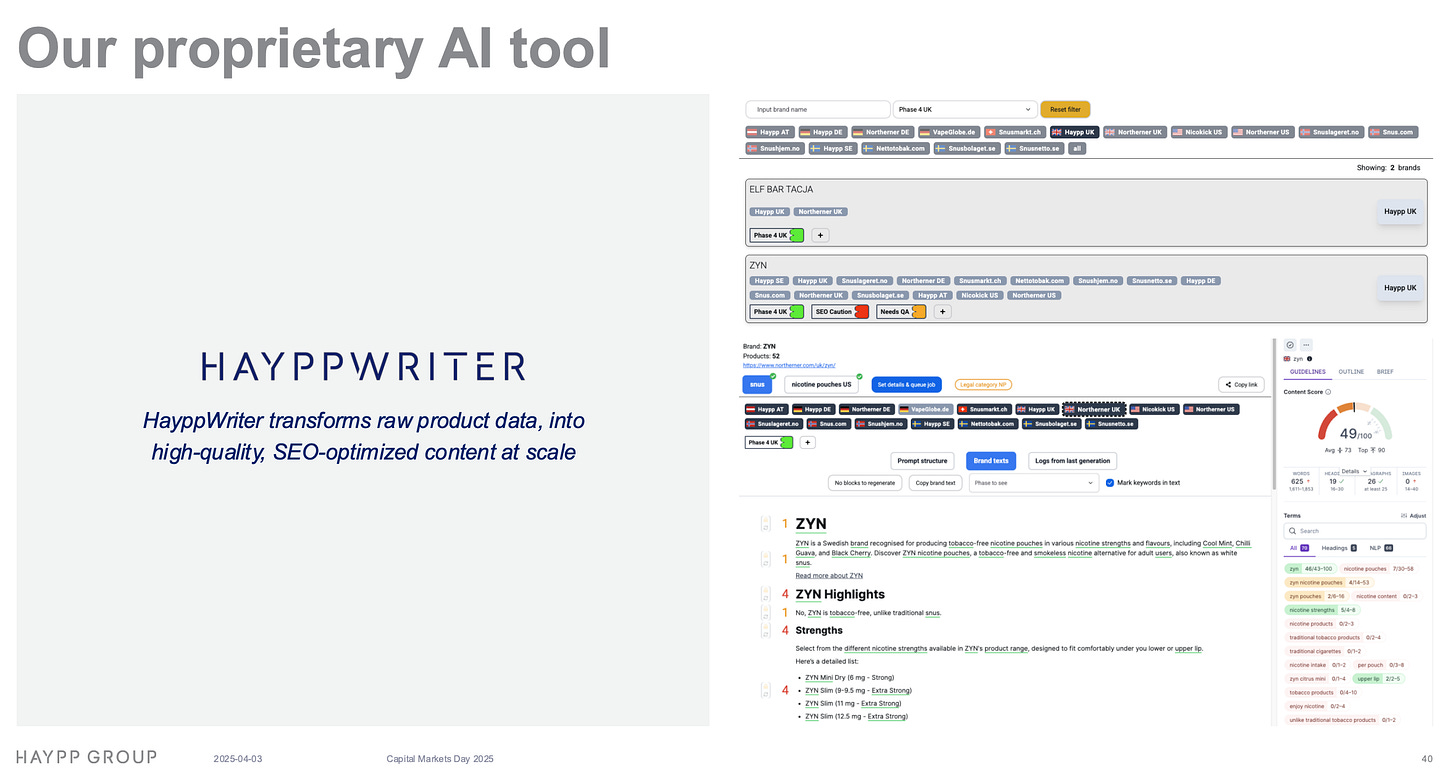

The search playbook is simple and aggressive; own the highest-intent queries so the top two or three Google results point to Haypp. When those positions are secured, almost all purchase-intent traffic flows to Haypp first. The company prioritizes organic growth; country-specific category pages; brand hubs; FAQs; buyer guides; clean information architecture; fast load times; and tight internal linking. Google rewards sites that keep users engaged and convert visits into purchases; strong dwell time and conversion feed back into ranking strength and make future wins easier.

An AI-assisted content system keeps product pages accurate at scale; when stock, pack size, strength, flavor name, or imagery changes, the underlying product data updates page copy and attributes across locales quickly and consistently. Fewer stale pages; fewer mismatches between site and warehouse; a steady stream of fresh, structured information that search engines can parse and trust.

Combine first-mover authority, trusted brands, and disciplined SEO capture and you get a moat. Competitors must spend years earning links and building helpful content while starting from behind on brand trust and type-in traffic. Ads are constrained in this category, so you cannot simply buy your way to parity. Haypp keeps publishing, updating, and compounding; the result is a search funnel that routes most high-intent traffic to Haypp.

Competition

Haypp is significantly larger than the next online player in its key markets; in organic nicotine-pouch visibility it is about 4,4x bigger in the UK; 4,5x in Sweden; 5,3x in the USA; and 7,4x in Norway. Outside these, the pattern is similar; Haypp usually leads by a wide margin across its footprint.

There is also a grey market. Unlicensed sites pop up; skip age checks; and undercut prices for a while. Gavin has said the grey market is not a real concern; these actors tend to run into payment, logistics, or regulatory problems and disappear.

Even among licensed rivals, short bursts of growth often come from pouring cash into marketing and discounts rather than from any lasting advantage. Some may look strong for a quarter or two; without a real edge they struggle to sustain it.

Direct competition is not what people usually ask about; the common questions are these: why wouldn’t Amazon sell nicotine pouches; can manufacturers go direct online; and couldn’t grocery delivery just add pouches to the basket.

Amazon first. Listing pouches would force strict age-gating at checkout and ID checks at delivery; warnings and record-keeping; and ongoing policy risk for a tiny revenue line relative to the rest of the marketplace. Extra verification steps cut conversion; compliance exposure rises; the payoff is minimal. The rational move for Amazon is to avoid the category.

Manufacturers next. PM briefly offered direct ordering; PM ended it. Going DTC creates channel conflict; undercutting retail partners looks like unfair treatment and strains distribution relationships. It also pushes brands outside their competence; high-performing e-commerce requires SEO; KYC; payments; fulfillment; and customer support at scale. Even with big budgets, the ROI is questionable when brick-and-mortar already delivers reach and margin.

Grocery delivery last. In theory a Whole Foods-type service could add pouches; in practice they would need age-gating at the point of sale and ID verification at the door; plus compliant product presentation and record-keeping. The operational burden and failure rates overwhelm thin per-can economics. Digital ID could make verification smoother over time; but generalist grocers would still struggle to match Haypp on price; assortment depth; and the structural data advantage that tunes merchandising and repeat behavior.

Management

Gavin O’Dowd; who he is and why he matters

Gavin O’Dowd has led Haypp Group since 2017. He is a chartered management accountant educated at Waterford Institute of Technology who started his career at Accenture and PwC before moving into nicotine at British American Tobacco, where he spent more than a decade across group corporate finance, CFO Iberia, and as general manager for Sweden and Norway. That mix of finance discipline and operating experience in Haypp’s core category is the spine of his profile.

On ownership, he is not a hired gun with no skin in the game. As of March 31, 2025, company disclosures show he held about 1,064,256 shares and 155,000 warrants. In mid-May he sold 100,000 shares in an off-market transaction at SEK 106; subsequent filings through late July indicated total holdings of roughly 912,000 shares, which still places him among the top ten owners.

O’Dowd is also a very visible operator. He fronts earnings calls and capital-markets presentations and regularly appears at category conferences like GTNF and ATNF to discuss regulation, harm reduction, and the e-commerce channel for oral nicotine. Media interviews through 2025 reinforce a consistent message on Haypp’s focus areas: SEO and first-mover advantages, building the insights business, tightening compliance, and sequencing geographic expansion rather than chasing headlines.

The throughline in his background is relevance. He ran P&Ls in Scandinavia when pouches and snus were already mainstream and understands the regulatory texture that defines Haypp’s day-to-day. He has lived the budgeting, portfolio, and channel conflicts faced by large manufacturers and now works the other side of the table as their most important online retail partner in multiple markets. That combination of category literacy and retailer pragmatism is rare.

My notes from watching him across interviews and webcasts: he is a neutral describer of events who does not sugarcoat setbacks or overhype wins. He is quick and specific on details, often answering with operational context rather than slogans, which signals he is on top of the numbers and the levers. He reads as a strong, active leader who keeps pushing the company forward without theatrics. Given Haypp’s size, he is a heavy hitter in this niche: credible with suppliers and regulators, comfortable with the public markets, and effective at aligning the organization around a clear playbook.

In short, O’Dowd brings exactly what Haypp needs at this stage: a finance-trained operator from within the nicotine world who is fluent in regulation, comfortable with sharp execution in e-commerce, and aligned with owners through a meaningful equity stake. As long as that remains true, investors have a clear read on who is steering the ship and how.

Other key leaders

Executive bench

COO and Deputy CEO Svante Andersson is the operating counterweight to Gavin; former CFO within the group and ex–Swedish Match analyst; he holds about 50 thousand shares and 140 thousand warrants. CFO Peter Deli brings GE, AmRest and BAT finance pedigree; he holds roughly 215 thousand warrants. Head of Legal & External Affairs Markus Lindblad anchors regulation and public affairs; he holds about 50 thousand shares and 192 thousand warrants. Commercial and growth are driven by CCO Gabriel De Prado, ex-BAT across Europe and LATAM; the US business is led by President US Peter Grafström, formerly MD at Philip Morris Norway. Supply chain density sits with CSCO Jonas Kolehmainen; brand and CRM with CMO Hans Strömblad van Eijk. In 2025 Haypp also added US compliance firepower with Issa Abuaita as Head of Legal and Laura-Leigh Oyler as VP Regulatory Affairs.

Board and key insiders

Haypp’s board is small, hands-on, and unusually owner-heavy for a listed company this size. The chair is Lars-Johan Jarnheimer, best known for chairing IKEA’s parent and Telia and for previously running Tele2. He brings big-company governance, brand, and telecom-scale operating experience. He joined as chair in 2025.

Founder Linus Liljegren sits on the board and remains a major shareholder, holding about 1.96 million shares through a partly held company. His presence keeps founder discipline in the room. Alongside him is long-time backer and operator-investor Patrik Rees, who holds roughly 3.63 million shares and has been on the board since 2016. Between them you have deeply aligned owners who think in years, not quarters.

Deepak Mishra adds global nicotine and strategy depth. He spent years at McKinsey and private equity, then served as Chief Strategy Officer at Philip Morris International and later led PMI’s Americas region. He is independent and does not hold shares, which keeps him clean on conflicts while bringing top-tier category insight.

Adam Schatz brings e-commerce and listed-company operating chops. He is President and CEO of Nuent Group and previously was CFO, then CEO, of BHG Group. He is independent with a small personal holding. Helena Juhlin Pink rounds out the digital edge on the board; she has senior experience from Google, Nokia, Spotify’s Soundtrap, and Adobe, and currently leads marketing at Fortnox on an interim basis. She is also independent and, like Deepak, has no shareholding.

What stands out is the mix: two materially invested insiders who know the playbook intimately, one founder, one owner-operator, and three independents who cover governance at scale, nicotine strategy, e-commerce scale-up, and modern digital marketing. Add a CEO who is a top-ten shareholder and you get tight alignment. The net effect is a board that looks overpowered for the size of the company, in a good way: heavy experience, real skin in the game where it matters, and enough independence to challenge management without drifting into bureaucracy.

Key risks

Haypp Group has many good sides; ignoring the risks would be foolish. I have referenced some risks in other sections; here I will go over the main risks I personally see and consider the gravest.

First: health-narrative and policy shock

First I’ll start with a key risk; new studies or public statements by powerful people could stall the nicotine-pouch boom. Today most people treat pouches as relatively harmless; but long-term data is limited; a single high-profile study showing unexpected adverse effects could slow adoption and invite tighter rules. There is also the risk that influential officials decide they dislike pouches for non-evidence reasons; that happens when decision-makers are uninformed. Haypp engages regulators to educate and align; yet regulators sometimes make poor calls; as we have seen in parts of the EU.

Second: littering and optics risk

On adverse regulatory shifts; the main risk I see is public littering. Nicotine pouches are turning up everywhere; streets; parks; golf courses. For some reason people treat used pouches differently from other trash like cans and wrappers; they just drop them; and they tend to sit where they land for a long time. The danger is obvious; policymakers may decide to act against pouches based on littering optics rather than health evidence. That action could be a tax; a local or national ban; disposal rules; or broad awareness campaigns. This worries me long term because it only takes a few high-profile complaints or photos to trigger reactions that slow adoption even if the underlying health case for pouches stays intact.

Third: the EU and the US

The US currently looks friendly for nicotine pouches; with RFK Jr. running health policy the federal stance is pragmatic harm reduction. There will be local exceptions; but nationally the tone is constructive. The EU is the wildcard. Brussels keeps floating new rules and member states interpret them differently; flavor limits; strength caps; online presentation; age checks; taxes; even delivery rules. That mix can change quickly and is a key risk to monitor over the coming years.

The good news is that there is plenty of information to track; consultations; draft texts; agency notes. Haypp also publishes periodic updates on its outreach in the EU; engaging with policymakers and explaining why pouches are better for public health than smoking. Keep an eye on EU-level proposals and how Germany; Austria; and other countries choose to implement them.

Fourth: search behavior is shifting

Another under-discussed risk is changing search behavior. ChatGPT and other LLMs are taking share from Google; there may come a point where traditional SEO loses relevance and new rules apply. Gavin has flagged this openly; the risk is real but contained. My view is that Haypp’s team will navigate the shift smoothly; their advantage is not only rankings but structured product data; fast catalog updates; and owned customer relationships via email; subscriptions; and direct traffic. If the discovery funnel moves from ten blue links to LLM answers, the response is the same playbook; clean data in; fast updates; authoritative content; and compliant user flows that convert.

Fifth: when no rules become the risk

One more risk that no one talks about enough is the absence of regulation and enforcement. If there are no real rules; or no one enforces them; the grey market can run rampant; operators skip age verification; permits; taxes; and product presentation standards; and undercut everyone on price. In that world Haypp carries the cost of doing things properly while unlicensed sellers don’t; margins compress; customer trust erodes; and the category becomes less profitable over time. Regulation is Haypp’s friend up to a point; sensible, enforced rules level the playing field and support sustainable unit economics; the lack of them does the opposite.

Sixth: mainstream retail entry with digital ID

The most talked-about risk is new entrants. If a major grocer like Whole Foods enables pouch delivery alongside groceries; and digital ID makes age verification instant; the convenience advantage narrows fast. In that scenario generalist retailers could leverage existing baskets; dense delivery networks; and loyalty programs to pull share; especially in the US. Haypp would face real market share pressure if mainstream delivery becomes seamless for age-restricted products.

Seventh: online channel risk

Selling age-restricted products online is still new; regulators are figuring it out. Standards for checkout verification; delivery ID checks; record-keeping; and product presentation are not uniform yet. That means rules can change quickly; a new guideline or an agency memo can add friction or limit what is allowed online.

So far the direction has been workable; most authorities accept that online sales with robust age-gating can be safer and more auditable than in-person cash sales. It is also common sense; in a modern economy you should not have to buy age-restricted items only in person. Still, the channel carries risk; extra verification steps can raise costs and lower conversion; couriers and payment processors add their own policies; and a few jurisdictions may tighten rather than loosen.

Net of it; the online channel is moving the right way, but it is not settled. Haypp needs to keep proving that its systems are strict; reliable; and easy to audit, so the default policy choice remains to allow compliant online sales.

Eighth: supplier concentration

The final risk I worry about is supplier concentration; like in the US with ZYN. When one supplier dominates, they hold too much leverage over Haypp; allocations, pricing, and timing can swing results in a way Haypp cannot fully control. This is not ideal. Fortunately the trend is toward a market with more players; but it is still worth watching closely. Rule of thumb: the more suppliers, the better for Haypp.

Closing the risk section

Those are the main risks I personally focus on; of course there is also the risk of competition; management execution; cybersecurity; and similar issues that every company faces. I have tried to touch on some of those elsewhere in this post as well.

Capital allocation

Haypp currently plans to reinvest essentially all cash back into the business; and will likely keep doing so beyond 2028; there is too much value to capture globally. Buybacks and dividends are on the table only when internal returns and M&A no longer clear a high hurdle. My speculation is that within roughly three years a larger share of free cash flow will be directed to acquisitions; Asia presents huge opportunities and would extend growth while improving diversification.

I also expect modest buybacks at some point to offset the dilution from ongoing incentive programs; the dilution is not massive, but the question of how necessary it is will soon become relevant. Overall, I think the team is skilled in capital allocation; I do not see a reason to fear misallocations.

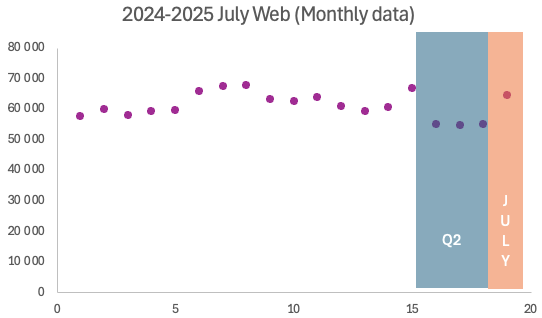

Web traffic

I track Haypp Group’s web traffic across all of its sites; it’s a solid way to get a rough read on where revenue is moving each quarter. In my experience these reads are usually within about 5 percent of reported revenue. I publish monthly updates on Haypp web traffic so you get a clearer picture each quarter; subscribe here to never miss a post.

Valuation

Valuation; how to think about it

I am not doing a full valuation here; instead I want to lay out the assumptions that matter if you build your own DCF. Start with margins. Picking apart today’s margins is not very useful; the focus should be on where they land in five years. Right now the goal is to win the market; the lower Haypp can price, the faster online takes share from the whole category. Pushing margins too early just slows that process; I see no reason to do that yet.

So what could margins look like later. My view is that the Media & Insights layer lets Haypp capture profits far above typical retail; add in regulatory know-how at scale and the operating leverage from search; and you get a setup where normalized margins can be surprisingly high for an online reseller. My base case is a 10 percent net margin in steady state. The structural advantages that Haypp’s data brings make that level achievable in my view; could it be higher over time; yes; but that is more speculative.

For sizing revenue growth I treat it like a big Fermi problem. A mature user can consume up to one can per day; the practical average is likely closer to one every second day. The product is superior to cigarettes in almost every way; so it is reasonable to assume that a similar share of the population that once smoked will use nicotine pouches in the future. That implies 20 percent of the population or more; with adoption spread across both genders, which widens the addressable base. I discount execution risk later; the point here is to frame the ceiling.

Remember that Haypp also sells vapes; but the main driver is pouches. Then layer in the lag effect between total category growth and online penetration. The United States has roughly 3 percent online penetration today; Sweden sits around 36 percent; simply closing part of that gap can create multi-year growth spurts for Haypp even before total category growth is considered.

Given this setup I would not be surprised if Haypp exceeds its own 18–25 percent CAGR target; at minimum the high end looks achievable. That range likely fits a longer horizon; near-term years can overshoot as cohorts mature and online mix catches up. The key takeaway is simple; Haypp has a long runway and the slope is yours to choose depending on how optimistic you are about long-term market growth. I am very optimistic; in my view the global market will rise above 100 billion over time.

Discount rate; what to use. This one is tricky. Haypp is a small cap on First North; liquidity is thin; the business carries real regulatory and execution risk; so a high WACC is reasonable. There are no clean comparables; beta-based formulas will mislead; and peer sets do not help much. In practice you have to set your own cost of capital. I personally use a discount rate close to 20 percent.

Valuation: S-curve modelling

When valuing Haypp, I find it useful to think in terms of logistic growth curves. In practice, this means estimating when each market will hit peak growth, while also making assumptions about online penetration and margin development. With these three components; market growth, channel penetration, and profitability; you can build a rough framework that mirrors the natural S-curve of adoption.

From there, one can discount the theoretical cash flows for each region and layer on scenario adjustments, such as the potential for outright bans in certain countries. This approach doesn’t give a single-point valuation but instead a structured way of framing the upside and downside paths.

I plan to write a separate Haypp valuation blog that dives deeper into this methodology.

Valuation summary

All in all, I think Haypp has more growth ahead than most investors expect, and its long-run margin potential is stronger than the market is pricing in. At the same time, a high discount rate is still necessary to reflect regulatory uncertainty and liquidity risk. Based on my assumptions, I arrive at a valuation range of SEK 193–450. The wide span is intentional: it is extremely difficult to pin down an exact fair value when so much of Haypp’s long-term upside depends on the US, which represents the largest growth opportunity by far.

In my own modeling, the US nicotine pouch market could reach something closer to USD 40 billion by 2045. If Haypp captures even a modest share of that, the long-term earnings power would justify a valuation well above the low end of my range. Still, I prefer to keep the hurdle high and build in ample room for regulatory setbacks and dilution risk.

Important events

When looking at Haypp it’s important to remember this is a business where negative headlines show up regularly: lawsuits, license reviews, shipping restrictions, supplier hiccups. That noise is part of the category. In this section I cover the ongoing and recent items that actually matter for Haypp and what they change, if anything.

ZYN supply in the US; what happened and what’s next

Haypp’s US business was constrained through much of 2025 as ZYN, the dominant pouch brand, remained in short supply. The shortage became most visible in Q2, when Growth Markets revenue declined year over year: US ZYN availability was restricted and California dropped out entirely following flavor and online shipping bans.

That picture changed in mid-September. Around the 11th, ZYN returned to Nicokick and Northerner after Haypp secured a direct distribution agreement with Philip Morris. This is important for two reasons. First, there had been speculation that Haypp might need to rely on third-party channels to restore supply; by instead securing PMI directly, Haypp not only gains better pricing but also ensures legitimacy and stability of volumes. Second, the deal underscores PMI’s willingness to support the online channel rather than sideline it.

With ZYN back on the shelves, Haypp’s Growth Markets are positioned for a sharp rebound. Given ZYN’s outsized share of the US pouch market, the regained supply will almost mechanically drive volumes higher. The impact is likely to be measured in the hundreds of millions of SEK in incremental revenue over the coming quarters. The risk of supplier concentration remains, but the direct link to PMI makes the outlook far stronger than just a quarter ago.

San Francisco and California; what happened and why it slowed growth

San Francisco has enforced a comprehensive flavored-tobacco sales ban for years; California then extended flavor restrictions statewide via Proposition 31 and tightened online sales from January 1, 2025. In practice this meant flavored nicotine pouches could no longer be sold into California; only unflavored SKUs remained lawful, and those too became constrained online.

Following these changes Haypp’s U.S. sites stopped shipping to California altogether, which removed one of the country’s largest state markets from the order mix and contributed to a noticeable slowdown this year. Northerner’s shipping page explicitly lists California among states not served.

The broader U.S. regulatory tone toward nicotine pouches is, however, currently constructive at the federal level. Health and Human Services Secretary Robert F. Kennedy Jr. has repeatedly characterized nicotine pouches as the safest way to consume nicotine and noted that nicotine itself is not carcinogenic; he was also widely reported and filmed appearing to use a pouch during his January 2025 confirmation hearing, with subsequent coverage indicating the product was ALP.

So while some localities will remain restrictive, the national stance does not look hostile right now. Even if sentiment were to harden later, by then the user base is likely to be very large and habitual, which makes outright rollbacks politically and practically difficult.

Sweden’s 2024 license episode; where it stands

In September 2024 the City of Stockholm’s Licensing Committee decided to revoke Snusbolaget Norden AB’s Swedish sales permit for tobacco products; the dispute centered on how age should be verified at delivery for traditional snus. Haypp appealed and continued operating during the appeal; importantly the decision covered only tobacco products and did not affect nicotine pouches. The company moved to age-verify at the point of delivery in Sweden; which addressed the regulator’s concern and kept service running. As of August 2025 the legal appeal is still in process; but operationally the issue appears largely fixed.

Investors should assume similar situations will recur. This category is regulated; interpretations change; municipalities and agencies test boundaries; and occasional headlines are part of the business. The flip side is Sweden’s broader policy direction; nicotine pouches are regulated under a dedicated 2022 law; the public-health strategy explicitly includes tobacco-free nicotine products; and Sweden’s smoking rate is among the lowest in Europe. In practice Swedish authorities have treated pouches as part of a harm-reduction path; even as they enforce strict rules on how products are sold and delivered.

Recent events; insider selling in Q2

There was warrant-related selling in Q2. It looks mainly like raising cash to exercise warrants and to fund life; most of the team isn’t on huge base salaries and a large share of their net worth sits in Haypp equity, so some selling is natural. It still makes you slightly uneasy; fair. Context matters; the stock had been soft before this window, so there was likely some pent-up supply dating back to the IPO. I treat it as normal portfolio management by insiders rather than a change in the fundamental story.

The French ban

Recently you might have seen headlines that France will ban nicotine pouches starting next year. While not a major surprise, the decision highlights the fragile regulatory landscape in many potential expansion markets. Haypp currently has no business in France, and the same applies to several other EU countries where the rules are either unclear or prohibitively restrictive. For now, Haypp cannot justify entry into these markets without stronger regulatory assurance.

Two takeaways stand out. First, irrational rules will be passed; it is part of the story in this category, and investors should expect setbacks of this kind. Second, the move reinforces where the real growth opportunity lies: the United States. Unlike France and other European countries that may adopt sudden bans, the US currently offers a supportive regulatory environment combined with a massive addressable market. France will likely serve as a cautionary tale: smoking rates there may remain stubbornly high while countries that embrace nicotine pouches see smoking decline rapidly.

Ownership; who holds the keys

Haypp’s register is tight; the top ten holders control 65.56 percent of capital and votes; others hold 34.44 percent. The largest positions are GR8 Ventures AB at 12.83 percent; Patrik Rees at 11.85 percent; Fidelity Investments at 9.91 percent; Northerner Holding AB at 9.79 percent. Rounding out the top tier are Wellington Management at 4.71 percent; Robotti & Company at 4.43 percent; Ola Svensson at 3.36 percent; Erik Selin at 3.27 percent; CEO Gavin O’Dowd at 2.98 percent; and Caro-Kann Capital at 2.44 percent.

Two takeaways. First; ownership is concentrated among informed, long-horizon holders who have shown little interest in selling despite the rally; that reads as conviction and aligns incentives. Second; float is thinner than the headline market cap implies; with 34.44 percent in broader hands the share price can move sharply on both buying and selling pressure.

Volatility and trading dynamics

When looking at Haypp it is important to remember that the stock is volatile. It is not a large company and it trades on First North; access is limited for many investors; liquidity is thin. As a result the share price reacts very strongly to negative headlines; but it usually corrects just as quickly. I have personally added multiple times on larger drawdowns; so far the stock has recovered within roughly a week after bad news.

The trading is not always rational. Multiples expand and contract aggressively; sentiment swings amplify every move. I would not be surprised to see the stock halve or double in the short term without any real fundamental change.

Investor interest; who is watching

I have been writing about Haypp actively for a year; interest has been steady from both funds and private investors. Most inbound comes from smaller family offices and boutique funds; the larger institutions I’ve spoken with often can’t touch it yet due to market cap; liquidity; and First North listing constraints. My take: there is real demand building, but many are not ready to buy yet; size; liquidity; index inclusion; and simple unfamiliarity are the bottlenecks.

What has surprised me is how diverse the interest is. Yes, there are many Swedish private investors; but I also see roughly equal engagement from Asia; the US; and the Middle East based on my own conversations. The watchlist is broader than you’d expect for a Stockholm small-cap; when the usual constraints ease, that audience can convert into real flows.

Catalysts

As of late September 2025, ZYN is back on Haypp’s US sites following the direct PMI agreement. That alone changes the near-term setup. The effect in Q3 will be partial, but from Q4 onward the regained supply should compound quarter by quarter as the US mix expands. This is the single biggest driver for Haypp’s next leg of growth, and I expect it to add meaningful volume over the coming years.

Since I first wrote about Haypp, the stock has already moved up substantially, driven in part by these catalysts starting to play out. Still, several remain on the table. The potential uplisting from Nasdaq First North to the main Swedish market would be transformational: broader broker access, US retail participation, improved liquidity, and larger funds with mandate constraints able to build positions. In my view, Haypp is approaching a threshold where re-rating risk tilts to the upside. The stock can grind higher in anticipation, then a single uplisting announcement could flip the story into wider recognition and substantial value appreciation.

The risks have not disappeared. Supplier concentration remains; if ZYN supply falters again without commentary, the stock can sell off. Sector risk matters too; if tobacco multiples compress, Haypp will get dragged down regardless of execution. Litigation and regulatory headlines will surface from time to time, and given Haypp’s illiquidity, drawdowns can overshoot fundamentals.

That said, the mix of renewed US growth, the likelihood of an uplisting, tighter spreads, and improved access to capital points to a credible re-rating path. Today Haypp trades around 1x sales; I see a realistic case for 2–3x as execution proves out and the investor base broadens. If the company keeps printing clean US growth and margins hold up, the market can quickly shift from treating Haypp like a micro-cap to paying up for a growth compounder.

Where to start if you want to dig in

If you are interested in Haypp and wonder where to start, I strongly recommend their CMD 2025. Many of the pictures in this blog are from there. Next, check all their recent quarterly reports of course. For something more niche, find one of the more recent fireside chats on YouTube. Robotti has done these and there are quite a few if you search for Haypp Group.

Closing thoughts

Writing this Haypp deep dive has been an interesting process. Since the last one, the stock is up roughly 10%, mainly on the back of ZYN supply returning. We have also seen some weakness; Gavin sold more shares, and the French ban headlines have made investors nervous. All in all, the thesis remains on track.

There is still a huge amount about Haypp that gives me conviction, and I could keep writing for much longer. If I missed anything important, ask me. And if you want regular updates on Haypp and the other stocks I follow; as well as all my new ideas; make sure to subscribe to my Substack.

Disclaimer

This is not financial advice; for informational and educational purposes only; not a recommendation to buy or sell any security. I am currently long Haypp Group (HAYPP); I may buy, sell, or change my position at any time without notice. I am not compensated by Haypp or any competitor; all opinions are my own. Estimates and forward-looking statements are based on my assumptions; they can change; outcomes may differ. Do your own research; consult a licensed advisor before acting. Investing involves risk; past performance is not indicative of future results. Accuracy and completeness are not guaranteed.

This was really good. Thank you

Insanely well researched and well written.

A joy to read!