Tempus AI: deep dive

A giant in the making

Over the past quarter century, Western economies digitized culture rather than production. The internet rearranged attention and advertising; it did comparatively little for the price or availability of food, housing, or care. Real productivity hardly stirred; we learned to click faster, not to build or heal more efficiently. That era is closing. Advances in computation and learning systems have crossed a practical threshold; their effects will begin to register in the physical economy.

The analogy is familiar. During the Industrial Revolution, machines displaced large tracts of manual labor; output rose because muscle met mechanism. Today the locus shifts from muscle to mind. As models approach human caliber in routine reasoning, the premium on many forms of day-to-day cognition declines. First, constrained tasks with limited contact with the outside world will be automated; then increasingly capable agents and embodied systems will act for us, extending decision and execution into the real environment.

This deep dive touches the field likely to feel the change earliest and most sharply; healthcare. It is information rich, process heavy, and chronically supply constrained. When guidance improves and guesswork recedes, waste falls; cycles shorten; scarce expertise scales. That is how artificial intelligence converts from spectacle into productivity.

The healthcare sector is far from optimal; in the United States it is often called a disaster. Enormous sums flow into the system; outcomes remain mixed. Science advances in areas like gene editing; yet core workflows still look the same. Processes are slow; costs are high; failure rates in development and care stay stubborn.

Real improvement requires a change in how work is done; not only in what therapies exist. The weak link is clear. Clinicians and researchers sit on vast troves of information; most of it is never used. Electronic records, images, lab results, genomics, device streams, and notes accumulate; data is fragmented, unstructured, and late to the point of decision. Time is scarce; incentives are misaligned; the default is to ignore most of what is collected.

The result is duplication, defensive choices, and trial-and-error care; in R&D it means long cycles and high attrition. Converting raw clinical data into structured, timely guidance is the bottleneck to unlock.

Warning

Everything in this text is speculative; the sector is still in the early innings of its S-curve and there are many uncertainties. Take everything here with a grain of salt. My understanding of the company is still developing; it is not an easy company to understand. Nothing in this post is financial advice.

Enter Tempus AI

Tempus AI was founded in 2015 by Eric Lefkofsky after his wife’s breast-cancer diagnosis made clear how little data guided everyday care; he has said that we give more technology to truck drivers deciding which pallet of water to pick up than to oncologists making life-and-death decisions. That gap is the company’s origin story and mission; structure clinical and molecular data at scale and turn it into decision support at the point of care.

The idea is simple; every patient encounter generates data. Basics like age, sex, and weight; richer inputs like labs, imaging, physician notes; even DNA sequencing. Today that information lives in silos; it is used once for a local decision; then it is effectively discarded.

Instead, the same data can feed a multimodal learning system; one that joins structured fields, free text, images, and molecular profiles. Such models can see patterns no human can hold in working memory; no doctor can evaluate a million interacting variables at once. The output is practical; ranked risks, likely diagnoses, trial matches, and treatment options that clinicians can act on.

The loop improves with use; each new case becomes training signal; guidance gets better; errors fall. Over time, routine parts of care could be AI driven; triage, scheduling, protocol selection, and standard follow-ups; with clinicians supervising exceptions and high-stakes calls.

The upside is large; small gains in high-stakes outcomes are worth a lot. Patients, payers, and providers will pay for faster answers; fewer errors; better allocation of scarce staff.

Take a simple example. If a pathway carries a 5% risk of death and better guidance lowers it to 1%, that is a 4-point absolute drop; an 80% relative reduction. Most people would pay materially for that; so would insurers and hospitals, because the avoided costs are large.

And it is not only mortality; earlier diagnosis, fewer adverse events, shorter length of stay, less trial-and-error on therapies, and higher trial-match rates all translate to money saved or revenue earned. A few percentage points on these metrics scale quickly across thousands of patients; that is why this market can support substantial budgets for tools that move the needle.

How big is the opportunity

The ceiling is vast; healthcare already absorbs trillions each year. If software automates even a slice of what doctors do; triage; protocol selection; documentation; ordering; interpretation; trial matching; the value shows up as hours saved and errors avoided across millions of visits.

The upside in discovery is larger still. Faster trials; better patient stratification; higher success rates; and earlier readouts compound into pipelines that waste less capital. The expected value of a single major therapy can reach tens of billions; lifting the probability of success by even a few points across many programs is worth a great deal.

Viewed this way, every percentage point of efficiency on a multitrillion base can fund substantial software budgets. That is why the addressable market for decision support and data platforms is effectively open ended; it scales with patients, providers, and pipelines.

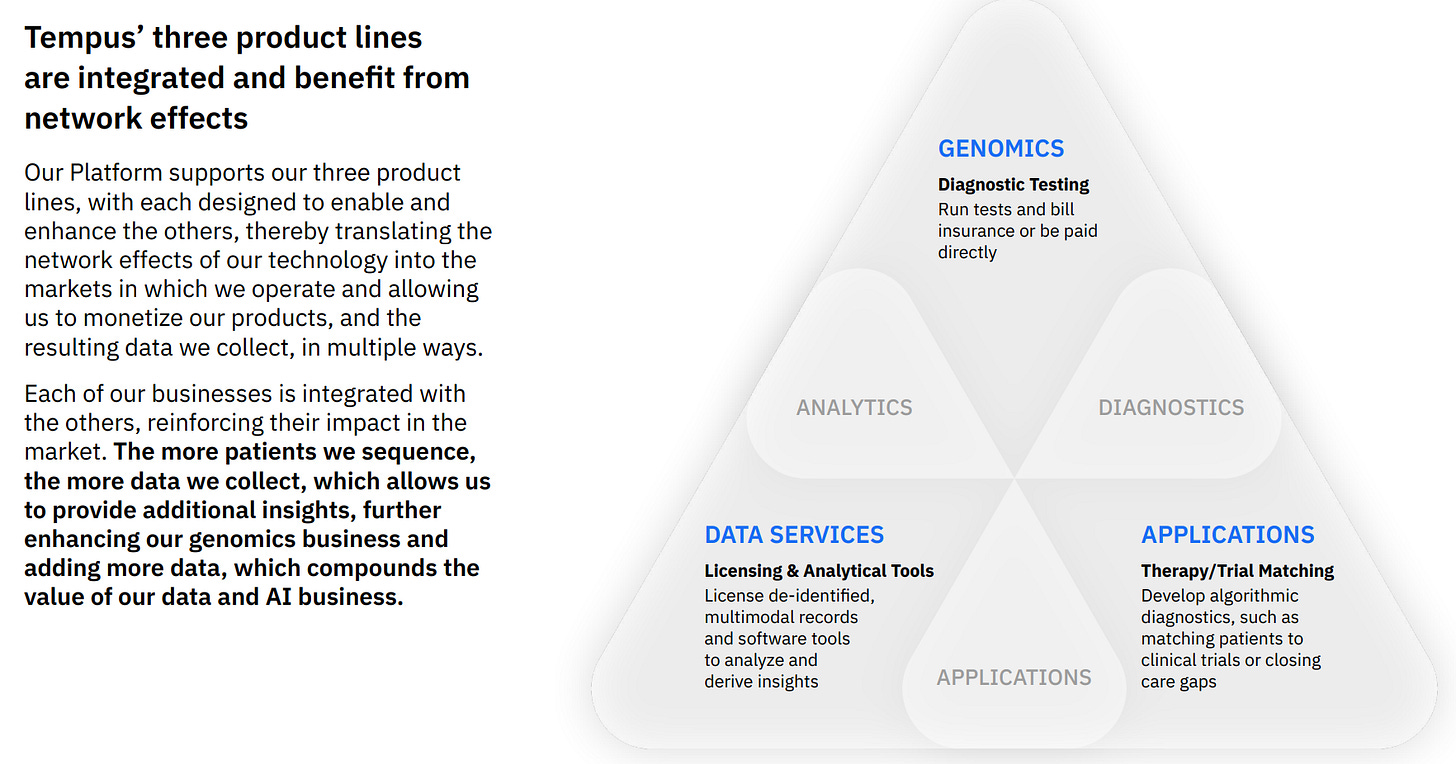

What they sell and who buys it

Tempus makes medical testing and turns the results into clear guidance for care; it also sells data and tools to drug companies.

For doctors and hospitals:

A doctor orders a Tempus test when they need more detail to choose a treatment; for example a tumor DNA test to see which drugs are likely to work or a hereditary risk test to guide screening. Tempus runs the test, pulls in the patient’s records, and returns a readable report with suggested options; it can also flag trial matches and risks that are easy to miss. Value is simple: faster answers; fewer blind guesses; better odds of picking the right therapy. The buyer is the hospital or clinic; payment usually comes from insurance or public programs that reimburse approved tests.

For patients:

Patients rarely buy directly; they benefit from more tailored care and, at times, shorter time to the right treatment. In some hereditary or self-initiated cases a patient may pay part of the bill; most often coverage decisions follow medical guidelines.

For insurers and health systems:

If care gets more precise, costs fall; fewer duplicate tests, fewer adverse events, shorter stays. Payers approve and reimburse tests that show clinical utility; some also buy analytics that help manage larger patient groups.

For drug companies:

Pharma pays Tempus for de-identified data and services. The data helps find the right patients for trials; the services help design studies and read results earlier. Value is speed and higher success rates; a small lift in probability across many programs is worth a lot.

In summary: Tempus sells medical tests that turn into point-of-care guidance, plus de-identified data and software for pharma; doctors and hospitals order tumor DNA and hereditary tests, Tempus ingests records and returns clear reports with options, risks, and trial matches, typically reimbursed by insurers or public programs; patients rarely pay directly but get faster, more tailored care; payers reimburse tests with proven utility and may buy analytics to manage populations; pharma buys data and services to find patients, design studies, and read results sooner. The business is anchored in testing because each test generates structured, outcome-linked data that trains the models, making reports more useful and driving more tests; revenue reflects this: Genomics was 65,1% of FY2024 sales and 76,9% in Q2 2025, while Data and Services contributed 34,9% and 23,1% respectively.

Why testing is the backbone

Every test produces structured data tied to real outcomes; that data trains Tempus’ models; better models make reports more useful; more useful reports lead to more testing. Revenue comes from per-test fees; software and decision tools; and research contracts. The loop funds itself and gets stronger as more doctors use it.

Genomics Product Line

Tempus AI’s genomics business revolves around high-throughput sequencing and testing, with revenue primarily generated on a per-test basis. These tests not only drive near-term revenue but also feed valuable data back into the broader Tempus ecosystem, creating a durable moat through continuous data accumulation. By 2023, the company had sequenced over 288,000 clinical samples, with strong growth continuing into 2025. This growing database fuels Tempus’s AI models, strengthening the network effects that make its platform more valuable over time.

xT (Solid Tumor Genomic Profiling)

Tempus’s flagship test, xT, is a next-generation sequencing (NGS) panel that analyzes DNA and whole-transcriptome RNA from solid tumors, paired with matched normal tissue for more accurate mutation detection. It is designed for oncologists, pathologists, and cancer patients seeking personalized therapy options. What sets xT apart is the integration of AI algorithms that not only identify actionable mutations but also recommend therapies and match patients to clinical trials, drawing on Tempus’s vast real-world data library for contextual insights beyond traditional sequencing. The xT test solves the limitations of standard biopsies by uncovering mutations, fusions, and expressions that directly guide treatment choices, reducing trial-and-error in cancer therapy. Importantly, every test generates a high volume of molecular data that enriches the Tempus database, creating powerful feedback loops where better data leads to better insights and wider adoption.

xF (Liquid Biopsy)

The xF test extends Tempus’s oncology toolkit by providing a blood-based NGS assay that detects circulating tumor DNA. It is especially valuable for patients who cannot undergo tissue biopsies or require ongoing monitoring for minimal residual disease and therapy response. Paired with xT, xF offers comprehensive profiling, while AI enhances its sensitivity to detect even low-burden disease. The test solves the invasiveness and inaccessibility of traditional biopsies, enabling dynamic, non-invasive monitoring of cancer recurrence and treatment effectiveness. By adding longitudinal data points to Tempus’s ecosystem, xF strengthens predictive accuracy across AI models and differentiates the company from pure-play lab competitors by tying diagnostics directly to a broader AI-driven platform.

nP (Pharmacogenomics Test)

Beyond oncology, Tempus’s nP test focuses on neuropsychiatry, offering genetic insights into how patients metabolize and respond to medications. Targeted toward psychiatrists, neurologists, and patients with conditions like depression or ADHD, nP uses AI to integrate genomic data with real-world clinical outcomes to predict both efficacy and side effects. This tackles the widespread problem of trial-and-error prescribing in mental health, reducing adverse reactions and ineffective treatments. By expanding into neuropsychiatric data, Tempus broadens the scope of its AI models and creates cross-domain synergies, while also attracting pharmaceutical partners interested in leveraging the platform for drug development.

Cardiology Genomics and AI Diagnostics

Tempus is also extending its reach into cardiology with genomic sequencing and AI-driven diagnostics, such as atrial fibrillation detection via ECG algorithms. Aimed at cardiologists and at-risk patients, these tools combine genomics with Tempus’s AI capabilities to predict cardiovascular events. Following the 2023 acquisition of Mpirik, Tempus now includes workflow tools designed to identify care gaps in heart disease management. The cardiology suite addresses the critical issue of undiagnosed or undertreated cardiovascular conditions, enabling earlier intervention and better patient outcomes. This diversification into cardiology not only enhances the robustness of Tempus’s AI but also builds credibility in non-oncology markets, as demonstrated by new research presented at the 2025 ACC meeting.

Taken together, these product lines show how Tempus leverages genomics to build a multi-specialty AI platform. Each test generates proprietary data that strengthens the overall ecosystem, creating a flywheel effect where more data drives more accurate insights, attracting more providers and partners, and ultimately reinforcing Tempus’s competitive moat.

Data Product Line

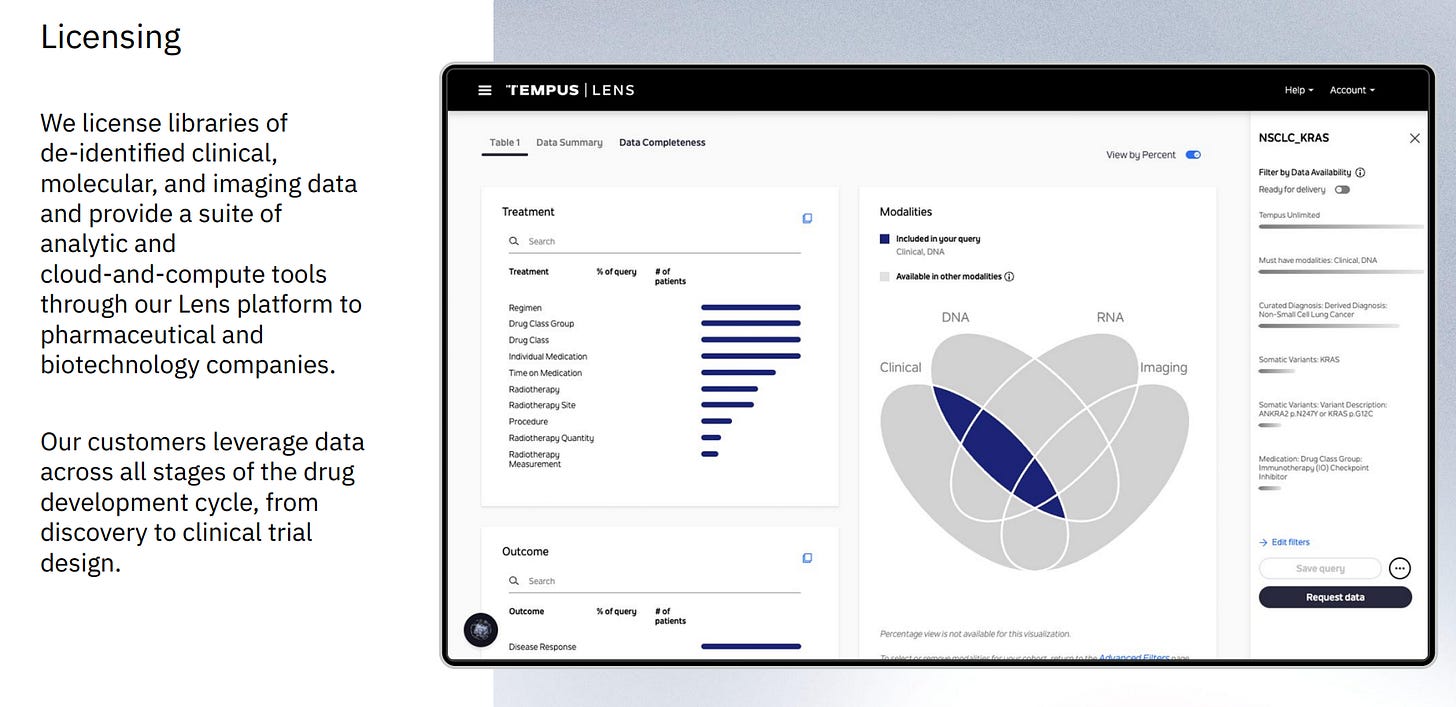

Beyond genomics, Tempus AI monetizes its massive dataset through licensing and services, primarily targeting pharmaceutical and biotech companies for research and development. This line builds a powerful moat by extracting long-term value from de-identified data: once collected, a dataset can be reused infinitely. For example, patient cohorts assembled in 2018 generated $48.8 million in revenue by 2023, illustrating the durability of Tempus’s model.

Lens Platform

Lens is Tempus’s cloud-based analytics platform, designed for pharma and biotech users engaged in drug discovery and development. It provides access to multimodal real-world data; including clinical, molecular, and imaging information; integrated with AI-driven querying. Lens is unique because it offers no-code cohort building and analysis, drawing near real-time updates from more than 450 data connections. This breaks down traditional silos, enabling faster, evidence-based decisions across the entire R&D lifecycle, from early target identification to post-market surveillance. By scaling the utility of data across multiple pharma partners (e.g., AstraZeneca, GSK), Tempus creates barriers through proprietary data harmonization. Over time, the genomics data feeding into Lens further enhances its AI models, reinforcing the platform’s value.

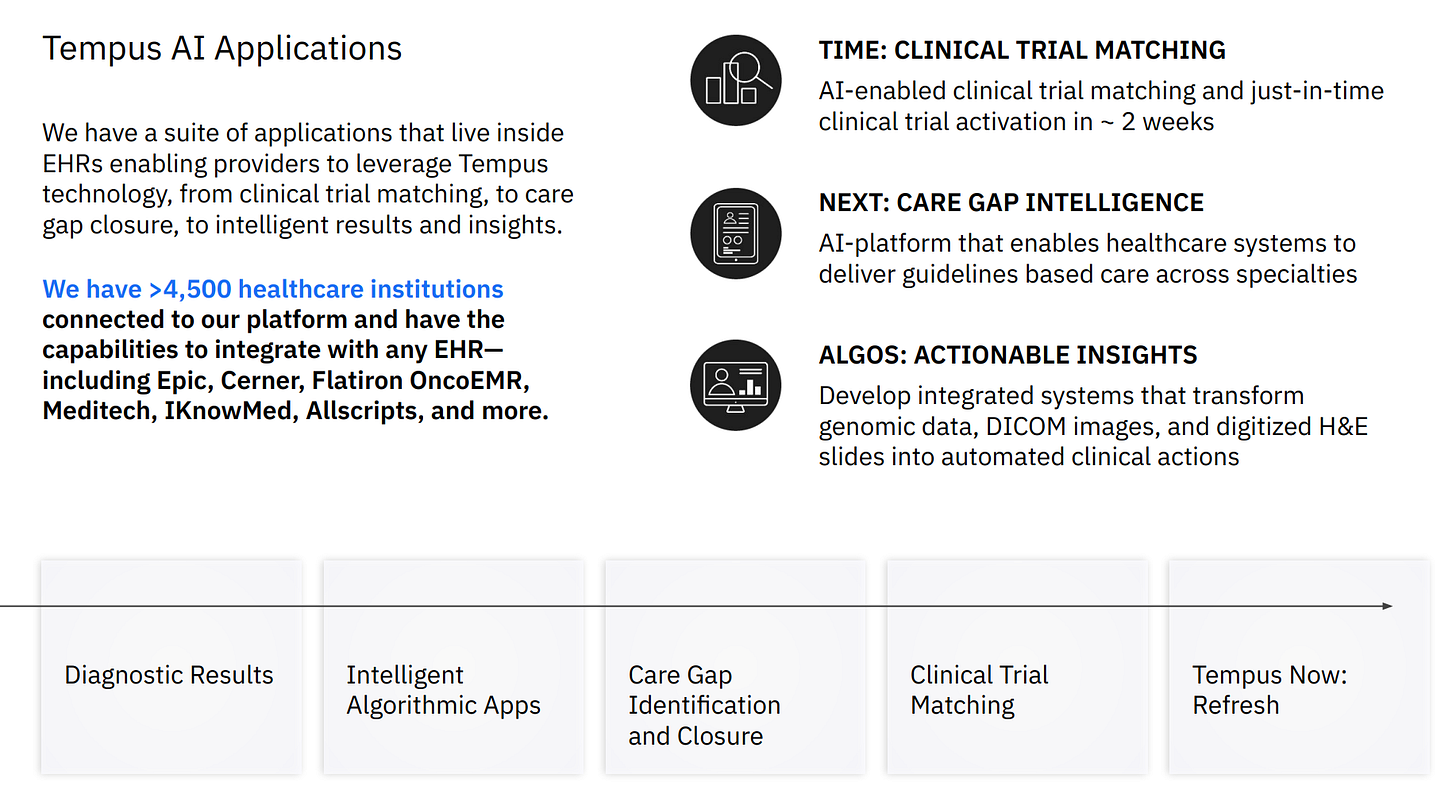

Time/Compass (Clinical Trial Matching)

The Time/Compass platform uses AI to match patients to clinical trials, leveraging Tempus’s network of electronic health records (EHR) and genomic data. It serves pharma sponsors, physicians, and patients by addressing one of the costliest bottlenecks in drug development: trial recruitment. What makes Time/Compass distinctive is its ability to access real-time data across Tempus’s provider network, which covers more than half of U.S. oncologists. This enables faster enrollment, more diverse patient participation, and more accurate trial matching. Acquisitions like Highline (2022) have further improved efficiency, helping Tempus lock in long-term pharma contracts while expanding its network and generating more data.

AI Applications Product Line

Tempus also monetizes its dataset by delivering AI-powered applications, often structured as SaaS products or medical devices. These tools apply insights back to clinical care, closing the loop between data collection and frontline healthcare. The moat here is strengthened by regulatory approvals, provider adoption, and integration into clinical workflows, which together make switching costs high.

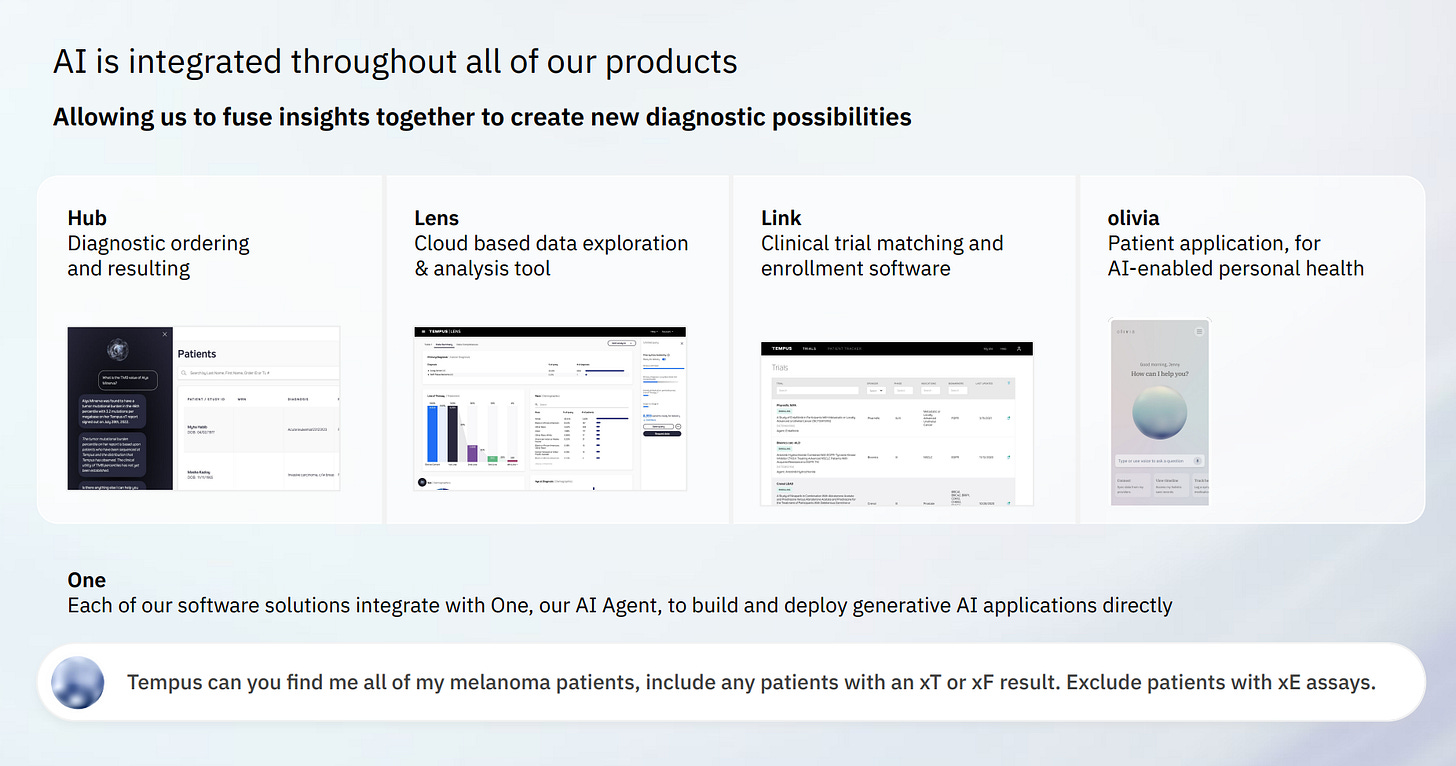

Tempus One

Tempus One is a generative AI assistant that allows physicians and researchers to query patient data across EHRs and generate custom insights. By integrating genomic, clinical, and outcome data, it delivers multimodal responses tailored to specific cases. This reduces the time doctors spend manually reviewing records and accelerates informed decision-making. With daily usage by providers, Tempus One not only improves clinical efficiency but also drives more data into the system, creating a self-reinforcing cycle of improvement and stickiness.

Tempus Next

Tempus Next focuses on care pathways, identifying and addressing gaps in oncology and cardiology patient journeys. Using machine learning, it proactively analyzes routine data to recommend next steps, such as screenings or treatment adjustments. Integrated directly with EHR systems, it minimizes missed opportunities and improves outcomes. The platform strengthens provider retention by embedding itself into workflows while also generating new data streams that refine Tempus’s algorithms.

Algos (e.g., HRD, MSI, Tumor Origin)

Tempus develops specialized AI algorithms that extend the value of its genomic assays. Examples include homologous recombination deficiency (HRD) scoring, microsatellite instability (MSI) detection, and tumor origin identification. These tools, trained on Tempus’s vast dataset, provide higher accuracy than competitors and are embedded directly into reports for oncologists and pathologists. Regulatory advantages, including FDA designations, enhance Tempus’s edge, while the scale of its data ensures that its algorithms continuously improve.

Tempus Pixel

Tempus Pixel is the company’s imaging platform, focused on radiology and cardiology. It analyzes multimodal imaging data; such as cardiac MR, chest x-rays, and lung CT; using AI. Following the Arterys acquisition, Pixel gained FDA clearance (September 2025) for automated MR quantification, a milestone that expanded its credibility in diagnostics. By accelerating interpretation and improving early disease detection, Pixel adds imaging data to Tempus’s ecosystem, enriching its cross-modal AI and extending the company’s reach beyond genomics.

Tempus Hub

At the center of the ecosystem is Tempus Hub, the unified platform where providers can order tests, access results, and integrate AI applications. Acting as the “operating system” for Tempus, Hub streamlines workflows and reduces administrative friction. More importantly, it increases user lock-in by centralizing all interactions with Tempus products, consolidating data, and reinforcing the moat created by the company’s scale.

Together, these data and AI application product lines transform Tempus from a diagnostic testing company into a fully integrated precision medicine platform. By monetizing data repeatedly, embedding AI into care, and creating regulatory and workflow lock-ins, Tempus strengthens its competitive position with each new use case.

The end game

Tempus is building toward one simple idea; an operating system for care.

Today they sell tests; turn results into clear reports; and give doctors an AI helper inside the workflow. That saves time; reduces guesswork; and improves choices.

Next step; the system starts to run more of the day to day. It suggests which test to order; pre-fills orders; ranks likely diagnoses; matches trials; drafts notes; checks for safety issues. Doctors and nurses stay in charge; the software does the heavy lifting in the background.

After that; it begins to manage resources. It books scans; balances operating rooms; routes patients to the right clinic; keeps queues moving. Hospitals already follow checklists; the difference is that the checklists become smarter and tailored to each patient.

Long term; you get something close to an AI corporation for healthcare. One platform decides what to test; which treatment is most likely to work; where to send the patient; how to follow up. Humans perform exams and procedures; handle edge cases; and make final calls. The system handles the rest.

Why Tempus could fill this role

They already have the backbone; high-volume testing that produces clean, labeled data; live connections into hospital records; AI that doctors can use at the point of care; and a patient app that helps people collect and share their records. More tests create more data; more data makes the AI better; better AI makes the service more useful; usefulness pulls in more hospitals and drug makers; the loop strengthens.

If it works, the payoff is large. Patients get faster answers and fewer dead ends. Hospitals raise throughput without adding staff. Payers avoid costly mistakes and delays. Drug companies find the right patients and read results sooner. Everyone benefits from the same engine getting a little smarter every day.

Next Steps

So far, Tempus AI has built a strong foothold in oncology and biotech research by supplying data and, at the same time, collecting it. The model works as a two-way street: every test and product not only drives revenue but also feeds more information back into the system. While oncology remains the core, Tempus has already begun extending its reach. Acquisitions in pathology and radiology show a clear intent to move beyond a single specialty and broaden the scope of its AI platform. At the same time, Tempus is experimenting with direct-to-consumer access through initiatives like its Oliva app. The overarching strategy is consistent: expand scope whenever and wherever possible.

Looking forward, I see several potential avenues for expansion. One particularly interesting angle is health tracking. If Tempus were to acquire a platform like Whoop or strike a partnership with Apple, it could add a layer of real-time, longitudinal health monitoring to its data. Today, Tempus’s strength lies in patients who already have a disease. But data that precedes the onset of disease; metrics like sleep, heart rate, or blood oxygen; could transform Tempus into a predictive engine. Imagine being able to forecast cancer risk or other conditions based on subtle biometric changes. That sort of shift would represent a step-change in value, though it’s more of a long-term possibility than something we should expect soon. It also opens up the question of whether a giant like Apple, already embedded in consumer health, might eventually want to own Tempus outright.

Beyond wearables, most other specialty expansions; endocrinology, pulmonology, gastroenterology, obstetrics; could be achieved through targeted acquisitions or in-house development. The one area that remains unclear is how Tempus will link into primary care. That integration is still a missing piece, but one that will likely become more important as the company pushes toward its vision of a comprehensive AI healthcare platform.

The pattern so far is unmistakable: every acquisition moves Tempus closer to an all-encompassing system. If the company keeps executing, we should expect continued expansion into new specialties, with M&A playing a central role in the strategy.

How the strategy forms a moat

Tempus’ edge begins with data; live pipes into provider systems, plus in-house sequencing, give it both breadth and depth. By mid-2025 the company reported connections to more than 40 million clinical patient records; about 9 million de-identified and ingested; ~1.1 billion healthcare documents; and a database exceeding 350 petabytes; fed by roughly 4,500 integrations. Scale like that is hard to replicate; it improves label quality, longitudinal coverage, and model performance; and it compounds as more sites connect.

The flywheel is straightforward. More providers and patients create more multimodal data; better models and decision tools increase clinical utility; higher utility attracts additional providers and biopharma programs; those contracts fund more sequencing and compute; which yields more data. Over time, the loop builds network effects: each new integration marginally improves outcomes for all other users, raising switching costs.

Regulatory footing reinforces defensibility. Tempus markets an FDA-approved 648-gene tumor profiling test, xT CDx; it also holds 510(k) clearances for AI cardiology software such as ECG-AF and ECG-Low EF. Cleared and approved products embed the platform inside hospital workflows; they establish trust; and they create procedural and reimbursement hooks that are difficult for later entrants to dislodge.

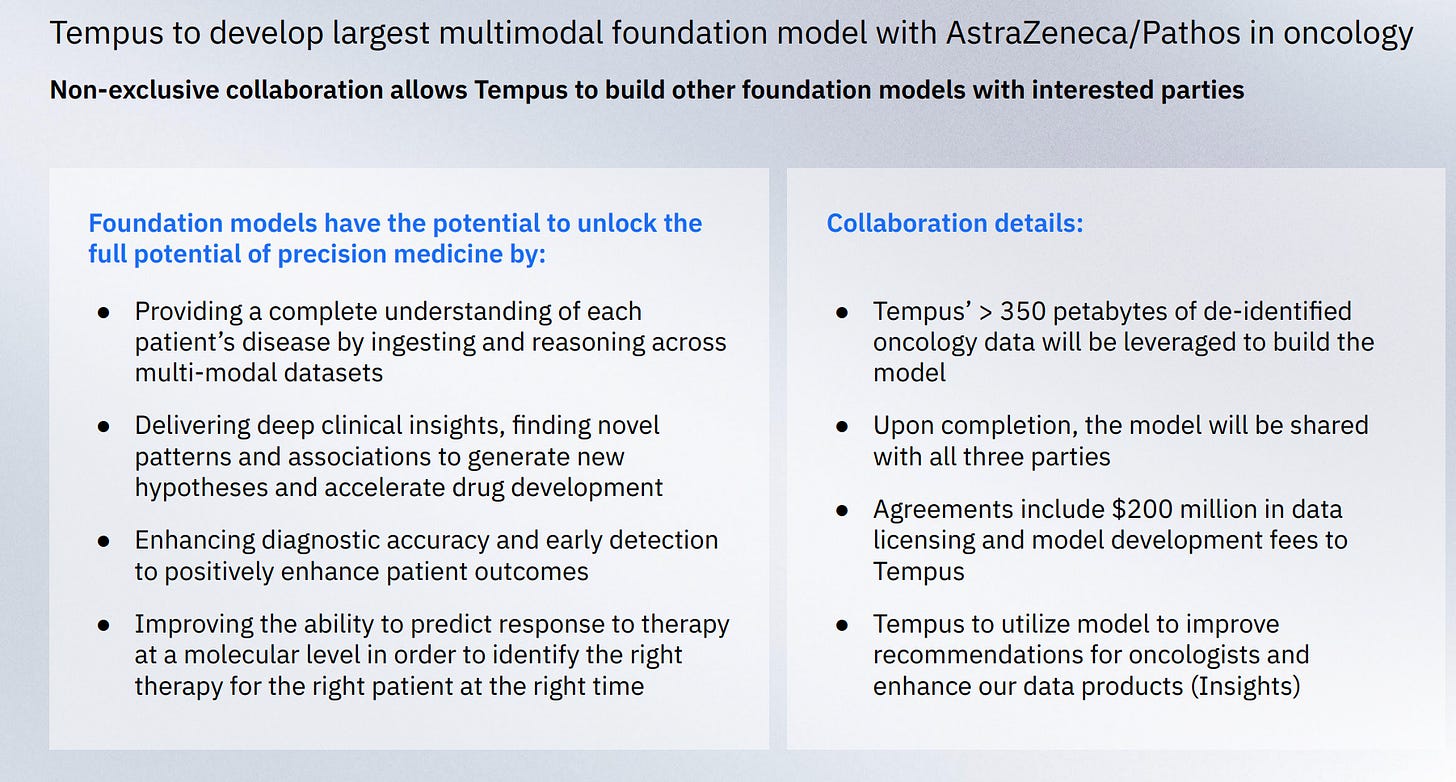

Partnerships and M&A extend the moat. Recent deals include multimillion-dollar agreements with AstraZeneca and Pathos AI to build a multimodal oncology foundation model; and the acquisition of Paige to strengthen digital pathology and expand the technical team and dataset. Each step widens modality coverage and increases the value of Tempus’ integrated corpus relative to point solutions.

Proof of ecosystem pull shows up in research output and customer mix. Tempus passed 500 publications supported or authored; and cites participation in nearly 1,500 research projects over ten years; a signal that academics and biopharma regard the data asset as differentiated. The more external work done on Tempus data, the more standardized its schemas and tools become; another sticky layer.

Finally, first-mover advantage and capital intensity matter. Since 2015 Tempus has built dedicated pipes to and from providers to move structured and unstructured data securely at scale; the operational lift, compliance work, and compute required create real barriers. In combination with regulatory clearances and a growing installed base, this architecture is the core of the moat.

Long-Term Competitiveness of the Tempus AI Sector

To get a sense of how valuable Tempus AI’s business model could become, it’s useful to step back and look at the sector through the lens of Porter’s Five Forces. This framework helps map the competitive landscape and assess how attractive the economics might be over the long term.

Bargaining power of buyers

In healthcare and biotech, the buyers; whether they are pharmaceutical companies, providers, or payers; are not only numerous but also highly motivated. When the product in question can accelerate drug development or improve patient outcomes, demand tends to be strong and relatively price-insensitive. This gives companies like Tempus significant leverage over buyers, a favorable position for long-term margins.

Bargaining power of suppliers

On the supply side, there are very few true “suppliers” to an AI healthcare platform. Once the data infrastructure is in place, Tempus essentially sits at the top of the value chain. Unlike traditional pharma or device companies that rely heavily on raw material inputs or manufacturing partners, Tempus’s primary input is data; something it collects and controls itself. This dynamic tilts the balance toward high profitability.

Competitive rivalry

Competition is the one area where risk is real. We will inevitably see large players try to outspend each other to build the most comprehensive platforms. However, at this stage, the race is still in its early innings. Tempus already has a head start in data scale, integration, and partnerships. Once a company builds enough network density; patients, providers, trials, and datasets; the switching costs rise dramatically. That makes it harder for new entrants to compete directly.

Threat of substitutes

The threat of substitutes is low. There is no obvious alternative to integrating multimodal data and AI for precision medicine. In many ways, this is the substitute to legacy approaches. Other methods; manual trial recruitment, siloed data, one-size-fits-all therapies; are what Tempus aims to replace.

Threat of new entrants

Barriers to entry are high. Building a comparable dataset requires years of sequencing, partnerships, and regulatory clearances. Even well-capitalized entrants would struggle to replicate the breadth of Tempus’s data and the flywheel effects it generates.

Overall view

Taken together, these forces suggest that the eventual winner of the AI healthcare/biotech race could be one of the most profitable businesses in the world. High buyer dependence, weak supplier power, strong barriers to entry, and minimal substitutes create a structurally favorable environment. The key variable will be how quickly competition consolidates and whether Tempus can maintain its early lead long enough to lock in its moat.

M&A as part of the strategy

Looking at Tempus AI through the lens of mergers and acquisitions, it becomes clear that the company is aggressively pursuing targets that expand its data foundation and broaden its product offering. Each deal is not just about buying a business; it’s about adding a new capability that strengthens Tempus’s push toward becoming an all-encompassing AI healthcare platform.

The approach is deliberate. Tempus looks for acquisitions that can add to its data and technology base while also being profitable almost immediately. That’s a critical distinction from how many pharma or biotech companies think about M&A. Instead of chasing long-dated R&D bets that might pay off a decade later, Tempus acquires assets that can plug directly into its existing workflows, generate revenue quickly, and feed back into its AI models. This way, every acquisition serves two purposes: it opens up a new set of customers and improves the quality and scale of the overall platform.

Over time, this strategy could allow Tempus to cover enough specialties across healthcare that its services start to resemble a vertical AI healthcare platform. A doctor might begin by using Tempus for oncology diagnostics but later rely on it for cardiology or psychiatry tools. Similarly, a pharma partner could use Tempus data to design a trial, recruit patients, and monitor outcomes; all within the same environment. The value would come not just from the AI itself but from the integration of multiple services into a single ecosystem.

This vision is still speculative. For now, we can only point to the deals Tempus has actually made. The three defining acquisitions to date show a clear pattern: buy specialized companies in genomics, imaging, and clinical workflows, then fold them into the platform. Each step makes Tempus both broader in scope and stronger financially, reinforcing the strategy of profitable, capability-driven M&A.

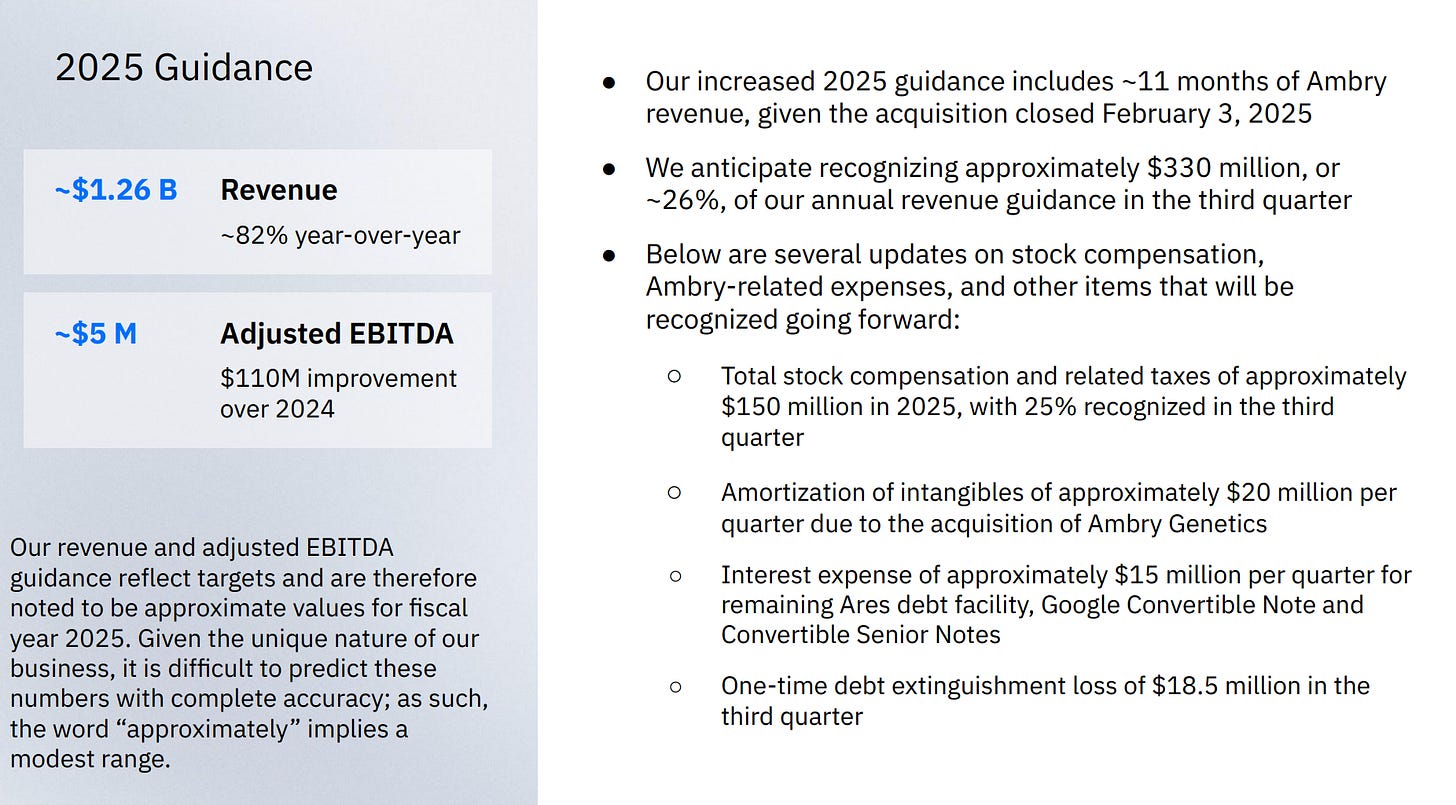

Ambry Genetics

Closed in February 2025, Ambry brought national-scale hereditary testing volume plus a deep catalog of variants and outcomes. It strengthened Tempus’ cash engine and added a stream of labeled germline data that improves risk models and trial stratification. Management’s Q2 2025 update shows Ambry already contributing materially to revenue.

Deep 6 AI

Announced in March 2025, Deep 6 adds trial-matching software integrated with more than 750 provider sites covering over 30 million patients. That footprint expands Tempus’ access to real-time clinical context and makes it easier to move patients into studies where data quality is highest.

Paige

Announced in August 2025, Paige adds almost seven million digitized pathology slides, FDA-cleared pathology AI, and a strong technical team. Pathology images are one of the hardest, richest modalities; pulling them into Tempus’ corpus improves models that connect genotype, phenotype, and histology.

Strategic build-outs sit alongside M&A. The 50–50 joint venture with SoftBank in Japan gives Tempus a second channel to collect and serve data at scale in a major market; it also validates the operating model with a demanding partner.

What ties these moves together is simple; more modalities; more coverage; more labels. Hereditary plus tumor genomics; clinical notes and labs; trial outcomes; now whole-slide images. Each addition makes the guidance more useful and raises switching costs for customers.

A second wave: the “virtual cell”

In parallel, a second revolution is taking shape in drug discovery; the virtual cell. Think of it as an in-silico cell; a software model that learns how real cells behave when you perturb them with genes or drugs. If the model is accurate, you can run thousands of “what if” experiments on a computer; then test only the best ideas in the lab. Reviews on digital twins in biomedicine describe the same idea in broader terms; virtual counterparts of biology that speed learning and lower cost.

Recent tools make this concrete. In June 2025 MIT and Recursion released Boltz-2, an open-source model that predicts both structure and binding affinity quickly enough to make virtual screening practical. Faster and more accurate screening feeds into virtual-cell efforts that aim to simulate cellular responses end to end.

Why this matters for Tempus

Virtual cells need massive, well-labeled, multimodal human data to train and to validate. Tempus already supplies such data to Recursion under a multi-year agreement that provides preferred access to one of the largest de-identified oncology datasets. Recursion agreed to pay up to 160 million over five years in cash or equity for that access; it even issued Tempus stock as part of an annual license fee. That is a clear read-through that Tempus’ datasets are useful for building causal models of disease and for in-silico design loops.

Put simply; Tempus’ M&A expands the raw material; the virtual-cell wave increases what that material can do. If virtual cells keep improving, they could compress timelines for finding drug targets; predicting toxicity; matching patients; and reading early signals of efficacy. That does not guarantee cures for cancer or Alzheimer’s; it does raise the odds that we test better ideas sooner and waste less capital on bad ones. Tempus is positioned to be the data backbone behind those efforts; acquisitions like Ambry, Deep 6, and Paige make that backbone broader and stronger.

Leadership

CEO

Eric Lefkofsky built his career by moving quickly through messy, high-growth arenas; that temperament makes him both effective and polarizing. He grew up outside Detroit and took both his BA and JD at the University of Michigan; after law school he and a college friend began buying and building companies, an early pattern of operating through cycles rather than waiting for perfect conditions.

Through the 2000s he co-founded a string of firms with data and workflow at the core; InnerWorkings in print procurement; Echo Global Logistics in freight; Mediaocean in ad systems; Lightbank as a venture shop; and most famously Groupon. The through-line is operational plumbing for large, inefficient markets; the reputation he earned is that of an aggressive builder who prizes distribution and speed.

Groupon is the chapter that still colors how people read him. The company’s sprint to scale made him a billionaire on paper and then dragged him through public controversy. Regulators questioned novel metrics and internal controls; Groupon restated results; class-action suits followed; and news outlets highlighted comments he made during the pre-IPO period. None of that erased the underlying achievement of creating a mass-market consumer brand in record time; it did, however, etch a picture of a founder whose ambition sometimes outran process. If you are an investor, that duality matters; it is part of the package.

Away from headlines he is a civic operator with deep Chicago ties. He has taught entrepreneurship at the University of Chicago Booth School of Business; published a business book, Accelerated Disruption; and, with his wife Liz, has been an active arts and education patron. In 2024 he was elected chair of the Art Institute of Chicago’s Board of Trustees; the couple’s foundation has supported local institutions ranging from Lurie Children’s to the Museum of Contemporary Art, where their gifts underwrite free admission for visitors 18 and under. These roles do not settle debates about his companies; they do round out the picture of a civic-minded executive with durable influence in Chicago’s cultural life.

As an operator, the consistent traits are velocity, comfort with scale, and a bias for data infrastructure. He tends to concentrate control; recruit experienced lieutenants; and pursue category-defining partnerships. Supporters see a visionary who can wire complex systems and raise capital for long games; critics see a founder whose earlier public-company chapter warrants extra scrutiny. Both views are reasonable; both are part of any fair read on Eric Lefkofsky.

Others

Jim Rogers, Chief Financial Officer

Rogers is a finance operator with a plain-vanilla toolkit and a bias for discipline. He came up through assurance at Ernst & Young; moved into regional FP&A and international controller roles at Groupon; and joined Tempus to run accounting, FP&A, treasury, and IR. The résumé is not flashy; it is built for blocking and tackling in a public diagnostics and software hybrid. The upside is process and predictability; the bear case is that critics still remember Groupon’s control issues and watch any Lefkofsky-adjacent finance leader more closely. Either way, Rogers is the one translating growth stories into audited numbers and guidance.

Ryan Fukushima, Chief Operating Officer

Fukushima is the internal architect. He started as an engineer at Cisco and VMware; shifted into venture at Hyde Park and Lightbank; and has been at Tempus since the earliest days, wiring provider integrations, scaling labs and data pipelines, and fronting ecosystem talks with biopharma and health systems. His public footprint mixes technical detail and commercial pragmatism; webinars, conference slots, and collaboration announcements frequently run through him. If you want a read on execution tempo, watch Fukushima.

Shane Colley, Chief Technology Officer

Colley is a healthcare IT product builder. Before Tempus he ran R&D at revenue-cycle firm R1 RCM, leading large product and engineering teams. At Tempus he sits over platform engineering and data infrastructure; not the headline-grabbing science, but the reliability, throughput, and security layers that make clinical products shippable. For an investor, the signal is enterprise rigor rather than research theater.

Kate Sasser, PhD, Chief Scientific Officer

Sasser is the translational counterweight to pure software thinking. She spent decades in oncology biology and precision medicine, most recently running translational research and R&D operations at Genmab. At Tempus her remit is scientific direction across assays and evidence generation. Her presence is a tell that Tempus intends to meet biopharma on scientific terms while keeping product cycles tight.

Ezra Cohen, MD, Chief Medical Officer of Oncology

Cohen brings frontline clinical credibility. He is a head-and-neck oncologist and former division chief and associate director at UC San Diego’s Moores Cancer Center. In practice, that means physician-level trust when embedding tools into real workflows, plus a network across academic centers. He represents the “does this help a doctor today” voice at the table.

Shane Woods, PhD, Chief Strategy Officer

Woods is a commercial strategist from Flatiron’s formative years, where he built enterprise partnerships with top oncology biopharma. At Tempus he incubates new businesses and deep customer ties. He is important to the “platform, not point solution” push; his background signals that Tempus wants durable, portfolio-wide deals rather than one-off projects.

Chris Scotto DiVetta, SVP and GM, AI Applications

Scotto DiVetta runs the applied-AI business line. Prior stops include NVIDIA’s Clara platform, GE Healthcare devices, and Quest Diagnostics, where he led advanced genomics and neurology. He is the bridge between model capability and sellable products; his remit spans care-pathway software, trial matching, and new diagnostics. If Tempus’ AI shows up visibly in clinics, it will often be through his group.

Mike Yasiejko, EVP and GM, Genomics

Yasiejko runs the genomics P&L, the revenue backbone that funds the data engine. Ex-Bain with a commercialization bent, he fronts many companion-diagnostic and research collaborations and speaks to the “research-first to market access” playbook. Readouts and CDx deals often carry his name.

Lauren Silvis, SVP, External Affairs

Silvis is the regulatory and policy heavyweight. She served as Chief of Staff at the FDA and deputy policy head at the device center before joining Tempus. That background matters for reimbursement, clearances, and rule-making around AI in medicine. She reduces regulatory unknowns and opens doors in Washington.

Erik Phelps and Andy Polovin, Legal Leadership

Phelps, formerly general counsel at Epic, now serves as EVP and Chief Administrative and Legal Officer; Polovin, a former federal prosecutor and Uptake GC, is General Counsel. Together they cover legal, quality, compliance, risk, and external affairs. In a regulated business handling PHI and FDA-cleared software, this pairing is a moat in itself; it is also a signal of how seriously Tempus treats operations beyond the lab.

Terron Bruner, Chief Commercial Officer

Bruner came from AWS, where he led global healthcare and life sciences sales. He is a cloud-native commercial lead tasked with converting pilots into enterprise-wide deployments across providers and payers. Expect him to push multi-year, platform-level agreements rather than transactional sales.

Why this team creates both substance and buzz

The operator mix blends venture-grown builders with big-provider, Big Tech, and FDA pedigrees. That combination calms adoption risk and accelerates productization. The “buzz” comes from visible conference presence and newsflow under Fukushima, Scotto DiVetta, and Yasiejko; the “substance” comes from Sasser, Cohen, Silvis, Phelps, Colley, and Rogers keeping science, regulation, and execution tight. For a stock picker, this is a team designed to turn datasets into regulated products and recurring revenue.

Shareholders

Tempus has a simple power structure that most readers miss; two share classes set the rules, and a small group of strategic and long-only holders provide the outside ballast. Class A carries one vote per share; Class B carries thirty votes per share and is economically identical but converts to Class A if it leaves controlled hands or when preset triggers occur, including a time-based sunset around 2044; this matters because control is durable yet not perpetual.

As of August 18, 2025 there were roughly 168.7 million Class A shares and 5.04 million Class B shares outstanding; voting is as a single class with the 1 versus 30 vote differential. Eric Lefkofsky holds all of the Class B shares through entities he controls and also owns a large block of Class A; in aggregate this yields effective majority voting power. On the record used for the company’s August 2025 information statement, the “Majority Holder” signed with 39.1 million Class A plus all Class B; that combination represents a clear majority of total votes outstanding. For investors, that means long-horizon execution with founder control; it also means governance will ultimately reflect one person’s judgment.

Beyond the founder block, the cap table contains a set of institutions that matter for different reasons. First are the long-duration growth funds that tend to underwrite data-network compounders; Baillie Gifford; T. Rowe Price; Franklin Templeton; Novo Holdings. They financed Tempus repeatedly in the private rounds and, based on public holdings data, remain among meaningful owners of Class A. Their presence is a quiet signal that the story has been diligenced for years, not months.

Then come the large index and core managers that stabilize a register; Vanguard; BlackRock; and similar holders appear near the top of institutional lists. Index inclusion does not predict returns; it does improve liquidity and lowers friction for future raises. It also anchors the stock in asset-allocation portfolios that are less reactive to headlines.

Two strategic relationships stand out because they are equity-linked rather than purely commercial. Google holds a convertible promissory note that originated alongside the Google Cloud agreement; the restated note has a principal amount of 250 million dollars and, if still outstanding at maturity, can convert beginning March 22, 2026 into Class A at a price based on the twenty-day trading average before that date. In practical terms, one of the world’s AI and cloud vendors is economically aligned to be on Tempus’ side for years. Google also participated as an investor in the late-stage private rounds, which likely converted to Class A at the IPO.

AstraZeneca holds a warrant struck at the IPO price of 37 dollars per share that allows it to purchase up to 100 million dollars of Class A; this is unusual for a diagnostics and data platform and signals expected collaboration depth in oncology analytics and trial enablement. Equity-linked paper from a top-ten pharma is, in effect, third-party underwriting of Tempus’ utility to drug development.

SoftBank is both capital and distribution. Reuters reported that SoftBank invested roughly 200 million dollars in the final private round just ahead of the June 2024 listing; in parallel the two formed a 50–50 joint venture to bring Tempus’ platform to Japan. That pairing is a vetting event; SoftBank tends to underwrite large, platform-style bets where it can also help with market access.

Company Culture

I’ve spent some time going through Glassdoor reviews and other sources, and a few clear patterns emerge. Tempus AI has a culture that some describe as toxic, while others see it as simply effective. The environment resembles a startup more than a mature corporation. Teams are frequently reorganized, and there are signs of suboptimal leadership. The company attracts talented people, but when it comes to managing them and cultivating future talent, Tempus seems to fall short. Internal leadership is definitely a weak spot and should be a key consideration when evaluating Tempus AI.

That said, despite being a multibillion-dollar company, Tempus continues to deliver products with tremendous growth. In that sense, the more chaotic, startup-like culture does make some sense.

Board: who sits at the table and why it matters

Tempus’ board mixes scientific star power, frontline clinical and regulatory experience, enterprise operators, and venture builders; a majority are independent under Nasdaq rules; the chair and CEO roles are combined under Eric Lefkofsky. Committee leadership includes Eric Belcher as Audit Chair and Peter Barris as Compensation Chair; the board explicitly reviews independence and committee requirements annually.

Jennifer Doudna

Nobel Prize in Chemistry 2020; co-pioneer of CRISPR; professor at UC Berkeley and head of the Innovative Genomics Institute. She brings scientific legitimacy and a deep network across genomics and academia; her presence signals that Tempus intends to align product claims with state-of-the-art biology.

Scott Gottlieb

Former FDA Commissioner; board member at Pfizer and Illumina; healthcare investor at NEA and policy scholar at AEI. He strengthens regulatory strategy, reimbursement awareness, and industry relationships; that matters for navigating clearances and payer decisions.

David R. Epstein

Former CEO of Seagen and former head of Novartis Pharmaceuticals; long track record in oncology development and commercialization. He sharpens the company’s read on how biopharma evaluates evidence and funds programs; useful when selling data, trial enablement, and companion diagnostics.

Wayne A. I. Frederick, MD

Cancer surgeon; President Emeritus of Howard University; interim CEO of the American Cancer Society. He adds clinical credibility and health-system governance experience; valuable when embedding tools into real hospital workflows.

Nadja West, MD

Retired U.S. Army Lieutenant General; former Army Surgeon General and Commanding General of Army Medical Command. She brings large-scale medical operations, quality, and risk management; useful for reliability and deployment at national scale.

Peter J. Barris

Longtime NEA leader; veteran enterprise investor and board member across scaled tech companies. He provides capital markets judgment and operating oversight; helpful for compensation design and audit discipline.

Eric D. Belcher

CEO of Numerator; former CEO of InnerWorkings. He is a data-ops operator with audit depth; as Audit Chair he is positioned to push process rigor and reporting quality.

Theodore J. Leonsis

Entrepreneur; co-founder of Revolution Growth; owner-operator of Monumental Sports. He brings distribution instincts, brand building, and public-company perspective; useful for partnerships and go-to-market.

This board is stacked with heavy hitters and, more importantly, it is diverse in the right ways. You have top-tier science through a Nobel-level genomics voice; frontline clinical leadership from major cancer centers and national health systems; regulatory depth from a former FDA commissioner; and operators who know how to run public companies at scale. That mix matters because connecting healthcare data into a living model is not just a math problem; it is evidence standards, reimbursement, workflow integration, security, and enterprise change management. A team like this can open doors at hospitals and payers; design studies that pass peer and regulator scrutiny; and keep reporting, incentives, and risk controls in line. In short, this is a board built to translate messy, real-world data into products that clinicians will trust and use; the kind of composition that gives a platform a legitimate shot at unifying healthcare data into a model.

Competition

A real vertical healthcare LLM needs three things: a place on the doctor’s screen; a lot of linked, real-world patient data; and the will plus money to ship safe tools. A few players qualify.

Epic

Epic already lives where doctors work. Its Cosmos database now pools anonymized records on the order of hundreds of millions of patients; multiple updates in August 2025 cite roughly 300 million unique patients. That is far larger than Tempus’ corpus in raw count. If Epic’s built-in copilot gets good enough, many hospitals will choose it because it is native, one login, one contract. In simple terms: more general clinical data; maximum distribution; and enough capital to keep training.

Google

Google has the model depth. MedLM, built from Med-PaLM work, is a healthcare-tuned family of models offered through Google Cloud. Hospitals and partners are piloting it for chart Q&A and workflow support. Google does not own an Epic-size clinical dataset, but it brings top research talent, heavy compute, and cloud contracts. If it turns MedLM into a safe, EHR-embedded copilot with strong retrieval, it can scale quickly. In simple terms: world-class models; big budgets; growing routes into hospitals.

Microsoft plus Nuance

Nuance’s DAX Copilot is already in hundreds of provider organizations for note-taking. That channel can add clinical reasoning as models improve. Microsoft also works closely with Epic, which gives it reach. Data advantage versus Tempus is weaker; distribution is strong. In simple terms: they sit in the room already; if the brain gets good, rollout is easy.

Roche’s Flatiron plus Foundation Medicine

In oncology, this pair has real weight. Flatiron says its curated oncology records now cover more than 5 million patients across multiple countries. Foundation Medicine reports more than 800,000 tumor genomic profiles and about 125,000 matched clinico-genomic records with outcomes. That is smaller than Epic in total, but focused and clean; and closer to Tempus’ sweet spot. In simple terms: deep cancer data; strong pharma ties; clear path to an oncology “doctor brain.”

Caris Life Sciences

Caris is building a very large whole-exome and whole-transcriptome dataset in oncology. Recent updates cite more than 900,000 profiles with hundreds of thousands matched to outcomes. If they keep pairing this depth with usable software in clinics, they can compete in cancer decisions. In simple terms: less breadth than Epic; deep molecular data that can rival peers in oncology.

Guardant Health with ConcertAI

Guardant brings high-volume liquid-biopsy genomics; ConcertAI contributes about 5.5 million clinical records. Together they can assemble a growing clinico-genomic asset outside Tempus’ walls and aim it at trial selection and care. In simple terms: strong cancer DNA data plus enough clinical context to train useful models.

How this compares to Tempus on data scale

Tempus reports roughly 40 million total patient records on platform and more than 300 to 350 petabytes of de-identified, multimodal healthcare data, including oncology-heavy genomics and millions of images. That is far smaller than Epic in raw patient count; larger than single-lab peers in multimodal oncology depth; and tightly linked to point-of-care testing, which matters for labels. In simple terms: not the biggest number of patients; strong cancer-focused data with rich labels tied to real decisions.

Valuation

Looking at Tempus’ valuation, I think most traditional metrics break down; it is not very useful to focus on current cash flow or even revenue. Yes, there is a solid, functioning business that acts as a backstop; but I treat the company like a startup with no cash flow.

Viewed this way, the right lens is real options. What new products could Tempus launch; how big could those products become. It is all about the data and what gets trained on it. I start from a multi-trillion vision of the company; then I discount it aggressively for execution risk across management quality, product velocity, distribution, regulation, reimbursement, and the competitive landscape.

On that basis, Tempus looks fairly priced right now; I see no reason investors would not pay more for a chance to own the future AI of healthcare, while downside is partly protected by the existing business. Yes, the stock could fall 50 percent or more on sentiment; but it also has real odds of becoming a trillion-plus company in the not-so-distant future. That asymmetry is the point.

It’s worth considering what Tempus would look like if the company stopped innovating altogether and simply focused on maximizing cash flow. Based on 2025 guidance, net margins could likely reach around 50%. That would translate to roughly $600 million in net income.

At today’s valuation of about $15 billion, that scenario would put the stock at roughly 25 times earnings. For a company still in heavy growth mode, that’s not unreasonable. And this is before factoring in what ongoing growth could mean. With its current trajectory, Tempus could realistically push revenues toward $5 billion within just a few years. If margins held steady, earnings would scale into the billions, making the valuation look much more conservative than it does today.

The main caveat is dilution. Tempus’s M&A strategy likely means additional equity issuance, and continued acquisitions will weigh on per-share results. That said, even when accounting for this, the combination of strong margin potential and rapid revenue growth shows how quickly Tempus could grow into its valuation if execution holds.

Existential risks; a short contemplation

The cleanest bear case is personal rather than technical. Tempus is built around a founder with decisive voting control; the vision and the pace live in his head. If Eric Lefkofsky chooses not to see the project through; retires after another liquidity event; or is credibly hit with governance or ethics questions, the thesis bends fast. You can hire operators; you cannot outsource conviction at this stage. The company can remain a good lab and data vendor without him; it does not become the operating system for care.

There is also the quieter version of the same risk; drift. A founder who keeps the chair but loses focus can be just as damaging as an exit. The work ahead is not PR; it is five to ten years of grinding integrations with hospitals, regulators, and payers. That requires sustained attention to dull details; permissions, data quality, evidence packages, reimbursement mechanics. If leadership attention thins, momentum erodes and the platform settles into incremental products rather than a category seat.

Execution is the other existential. The promise assumes that messy, real-world data can be cleaned at scale; stitched across sites; and turned into guidance that doctors trust and act on. It assumes M&A targets harmonize; that models improve with more modalities; that deployments expand from pilots to defaults. If any of those links fails in practice, utility stays local and the flywheel does not compound. In that world Tempus is valuable; just not dominant.

Everything else sits below these pillars. Regulatory timing, payer codes, and competition matter; but they are survivable if the founder drives relentlessly and the team executes. The binary outcomes are simpler. Either the person with control carries the mission to completion and the organization delivers at hospital scale; or he does not and the story resolves into a capable diagnostics and services company without platform economics.

Finally, if you have made it this far, I recommend reading this short report; it is a bit scattered, but it is useful for understanding the main risks.

AI Washing

One common critique of Tempus AI is that the company rebranded during the height of the AI boom, which gives the impression of “AI washing.” Further reports suggest that only a minimal share of revenue is directly tied to AI, raising doubts about the depth of their technology and how advanced their product really is. Some argue that Tempus is little more than a data broker with an AI label attached.

At the same time, many high-profile users claim that Tempus’ services deliver drastically improved results, which would suggest a real competitive edge in AI. It’s also worth noting that with a company of this size, the ability to recruit top talent becomes a self-reinforcing cycle: the more people believe in the AI story, the better the hires, which in turn improves the technology.

That said, caution is warranted. The valuation gap between a biotech tools company and a true AI company is vast. If Tempus is ultimately viewed as the former rather than the latter, its current valuation would be difficult to defend.

Sentiment

When I research a stock, I don’t just look at the fundamentals; I also like to examine the social sentiment around it. This gives me a clearer picture of why the stock is valued the way it is.

In the case of Tempus, the observations are interesting. First, chatter on X is surprisingly minimal. There’s very little serious discussion about what the company is actually building or how that might affect revenue. Instead, most of the noise comes from chartists or retail traders who stumbled across the name because of Pelosi’s or Cathie Wood’s trades. The majority of comments reflect only a surface-level understanding of the business, with “AI healthcare” being the most common description.

Whether this is good or bad is hard to say. On one hand, it reminds me of Palantir a couple of years back, when many retail investors recognized the stock name but had little idea what the company really did. If Tempus follows a similar path, there could be upside as more investors begin to understand the fundamentals and long-term story, rather than just pressing the buy button because it’s branded as AI.

On the other hand, the presence of options traders and momentum chasers following Pelosi and Cathie Wood could inflate the stock in the short term, setting it up for disappointment if expectations get ahead of execution.

Catalysts

Tempus is roughly a 14 billion company; real price moves require real pressure. The cleanest path is a revenue inflection. Testing keeps the engine running; as the assistant and workflow tools become too valuable to ignore, usage spreads across clinics; revenue accelerates. That is the first-order catalyst.

There is also a possible “ChatGPT moment.” In a single budgeting cycle doctors could start using the assistant by default; habits flip; procurement follows. The timing is uncertain; the setup is there; I treat it as a medium-confidence spark rather than a base case.

The strongest near-term driver is simpler; investor understanding. Too few people engage with the business mechanics; most commentary circles the ticker rather than the model. As the story lands; tests as the cash engine; AI as the pull; data as the moat; the multiple can expand. The market has already shown a willingness to award platform valuations to names like PLTR and Anthropic; if investors grasp the scope of Tempus’ impact, a rerate toward that tier is plausible.

My Take

At this stage, Tempus looks like a strong buy if you have a long horizon. On fundamentals and positioning, I’d be inclined to go as heavy as possible into the company. But there are real concerns that can’t be brushed aside.

The biggest open question is leadership. I haven’t fully made up my mind about the CEO; can he be trusted to carry out the mission? Is there a risk of overpromising, or even something more serious like fraud? And beyond the top level, is the company’s culture too toxic to sustain long-term growth?

These are not easy questions to answer, and I don’t expect to have clean answers anytime soon. They remain key points I’ll continue to track as I follow the story.

End note

The investment thesis here is highly uncertain; ideas like the virtual cell and deep AI integration in hospitals may not happen or may take a very different shape. Doing a deep dive on Tempus is especially difficult because the company evolves so quickly; during the course of writing this, they secured two new FDA clearances. That pace of change means I have to accept a certain level of incompleteness. I still need to do much more digging; understanding a company like Tempus takes time. I’ve concluded that publishing and iterating is better than waiting for a “finished” view. I will keep updating this write-up as new facts emerge, with the aim of inviting scrutiny and surfacing information that could shift my perspective on the company and the sector.

Thank you for reading; please subscribe for regular deep dives and commentary on the stocks I follow; feel free to share the post if you liked it.

Nothing in this write-up should be taken as financial advice. It reflects my personal research and evolving views, and it may contain errors or incomplete information. Do your own due diligence before making any investment decisions.

This is hands-down the most comprehensive investement thesis I've read on any healthcare AI company. The depth here is extraordinary - from the founding story (Eric Lefkofsky post-wife's cancer diagnosis) through product line architecture (xT/xF/nP genomics, Lens platform, Time/Compass, Tempus One AI assistant, Next care pathways, Pixel imaging) to board composition analysis (Jennifer Doudna Nobel + Scott Gottlieb former FDA + David Epstein former Seagen CEO). Your real options valuation framework makes complete sense for this stage company - traditional DCF models break when you're trying to value a potential AI operating system for healthcare with 40M+ patient records, >350 petabytes, and flywheel compounding effects that accelerate with each new provider integration. The M&A strategy is clearly the key to platform expansion - Ambry Genetics adding hereditary germline volume, Deep 6 AI bringing 750+ provider sites covering 30M patients for trial matching, and Paige contributing 7M digitized pathology slides with FDA clearance. What I find particularly compelling is the Recursion partnership ($160M over 5 years) around virtual cell modeling - the convergence of clinical data + virtual biology could genuinely compress R&D timelines by an order of magnitude. The bear case around founder dependence is valid though - Class B shares with 30x voting power until 2044 means everything rides on Eric Lefkofsky's sustained focus. Given the Groupon history (restatements, class actions, metric controversies) this isn't just theoretical risk. The Spruce Point short report you linked raises legitimate culture and AI washing concerns. Still, with Epic at 300M patients, Roche/Flatiron at 5M oncology records + Foundation 800K genomic profiles, and Guardant/ConcertAI at 5.5M records, the competitive landscape is real but Tempus's integration depth (multimodal data tied to point-of-care decisions) creates defensibility that pure data aggregators lack. Your $14B valuation looks fair for the existing business backstop with 50% net margin potential on $1.2B revenue, but the real asymmetry is the trillion-dollar platform scenario vs. 50% downside to quality diagnostics/services multiple. This is one of the clearest articulations of the AI healthcare thesis I've seen. Exceptional work.