Execution Memo No. 002

New positions; Haypp keeps compounding; 2025.09.15

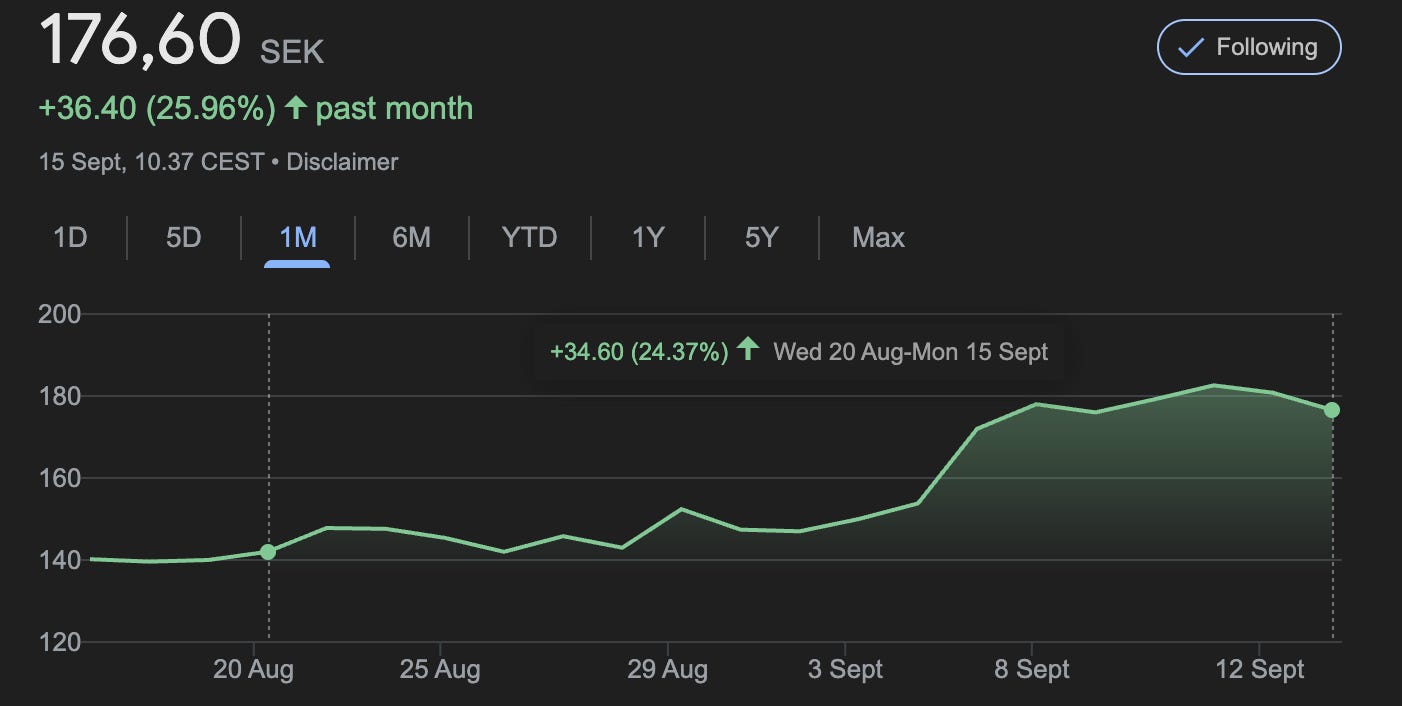

If you are new to my newsletter; in this series, Execution Memo, I cover what I buy and sell; and the reasoning behind my actions. Since last time, roughly three weeks ago, my portfolio is up a further 20%; largely thanks to Haypp; I will discuss that below. I will also touch on two new positions I have added; Tempus AI and Nebius Group; and why they are interesting; plus how I have structured them with options.

Reflection from last Execution Memo

It has been roughly three weeks; a lot happened. I was excited about Haypp’s web-traffic trends and incoming catalysts (Zyn supply); the market finally reacted to the underlying bullish momentum; I am now up 101% YTD. I also wrote about selling Lululemon on conflicting signals; web traffic pointed to a miss while Google Trends hinted at a beat. I exited with a 7% gain because I trusted web traffic over Google Trends; the stock is now down more than 20% from my sell. Lastly, I outlined the macro setup into year-end; in a positive M2 environment I still think it is “safe” to lean into growth. That is why I moved the freed-up cash from Lululemon into two options positions. I will cover them next.

Tempus AI: the most promising stock ever? too promising

If you have been paying attention; I wrote a short piece on Tempus AI; basic pitch only. Since then I have been writing a deep dive; it keeps getting longer; I might post it soon. I bought a position last week. The upside is enormous; this can be a trillion-dollar outcome if it works. Healthcare is a mess; it still feels primitive next to other tech; that is about to change. Techbio is, in my view, the next big thing over the next year. Tempus looks like the current front-runner.

Keep reading with a 7-day free trial

Subscribe to Emil Hartela Investing to keep reading this post and get 7 days of free access to the full post archives.