Execution Memo No. 001

When Data Shifts; Positions; Plans; Perspective; 2025.08.23

Welcome to the first Execution Memo. This is where I share what I am doing; what I plan to do; and why. Yesterday I exited a position after the data shifted; inside I explain the signal issues and the decision path. I also added more Haypp on weakness; inside I explain why and what I expect next. Finally I outline the plan for the year ahead; where I aim to add; what I will avoid; and how I will manage risk.

Lululemon the falling knife

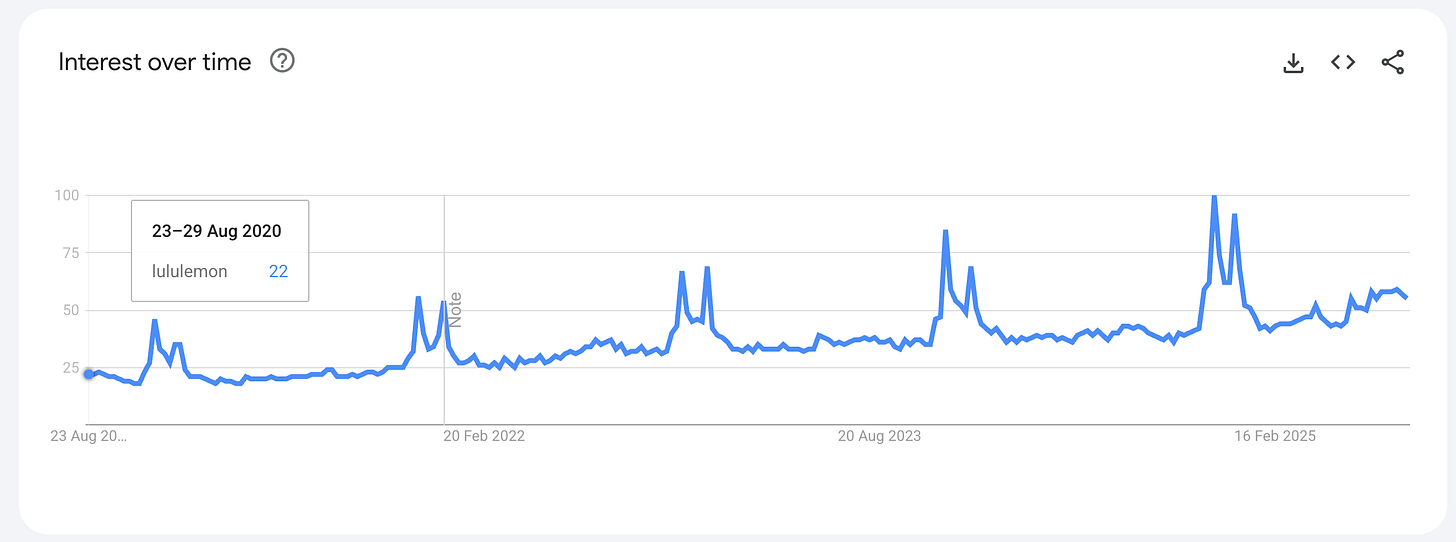

Roughly two weeks back I pulled the trigger and bought a semi-sizable position in Lululemon. The logic was simple; the stock had fallen about 60% from its peak on fears the brand is fading in the U.S. as competitors like Alo gain share. That may be true domestically; but I have watched the brand run hot in Asia and the EU. In those markets, if you want fashionable performance wear, Lululemon is often the only real option. On the data side, Google Trends sat well above baseline; that would normally hint at a strong print. U.S. web traffic, however, had not moved much. I chose to overweight the Trends read and my on-the-ground observations from Japan and Europe; paired with a compressed valuation, it looked like a reasonable hold into one or two earnings cycles.

Two weeks later the position was up 7,5%. Then I encountered a credible thread arguing Google Trends may be less reliable right now. The mechanism makes sense; LLM activity can generate large volumes of automated queries that inflate Trends interest. I cannot size the distortion with confidence; but a non-trivial chance that the series is corrupted is enough to invalidate the signal. When the core input is compromised, I lose my edge.

So I exited yesterday and took the gain. The stock may pop on the next catalyst; that is speculation without clean data. I will revisit once I can rebuild a trustworthy signal.

Hyped about Haypp

Last week I made one more add to Haypp; on top of my post-earnings add; because total web traffic keeps coming in stronger. Versus the Q2 baseline it is running a bit over 20% ahead; historically traffic and revenue have moved together in a roughly linear way; if we finish the quarter around this level I read the print near 1 100 MSEK. There is also a real chance ZYN supply snaps back any week; that would almost instantly lift sales by about 100 MSEK and puts Q4 closer to 1 200 MSEK.

Keep reading with a 7-day free trial

Subscribe to Emil Hartela Investing to keep reading this post and get 7 days of free access to the full post archives.